Frequently asked questions on Dossiers of Regulation Temporary of Employment (ERTE)

What is an ERTE, specifically in the situations of COVID-19?

It is the procedure that they have to carry out companies when, as a result of economic reasons, techniques, organisational or of production, they have temporarily suspend the entirety or part of its activity, with the consequent suspension of employment contracts or the temporary reduction of the work day of hard-working people in this company.

The extent and duration of the measures of suspension of the contracts or of reduction in working hours will be adapted to the current situation that is expected to exceed, in this case to the situation derived from the COVID-19.

When being a temporary measure, the company will not have to pay indemnity one to the hard-working people affected, without prejudice to the right of these to receive corresponding provisions of unemployment.

Definition and clarification of the concept of force majeure

The Royal Decree-Law 8/2020 specifies in what consists the temporary force majeure derived from the Covid-19:

The suspensions of contract and reductions in working hours that have its direct cause in as a result direct activity losses of the COVID-19, included the statement of the state of emergency, that involve:

- activities suspension or cancellation,

- temporary close of local of public influx,

- constraints in the public transport and of the mobility of people and/or merchandises,

- lack of supplies that they impede seriously to continue with the ordinary development of the activity,

and also the owed extraordinary and urgent situations to the contagion of the staff or the adoption of isolation measures preventive decreed by the health authority.

How present an ERTE if I do not have electronic certificate?

The company will send an email to sgrl@mitramiss.es indicating a contact phone number, the address of the work centres and a relationship of hard-working people for work centre. From that mail information will provide him to him on the way of proceeding.

Any company that does an ERTE will be able to benefit from the exoneration of social contributions?

Not, not all the companies affected by an ERTE have right to the exoneration of fees, the abundant standard that has been gone publishing from the Royal Decree Act 8/2020 of 17 March, has gone regulating the motivation of companies according to the evolution or situation of the pandemic (via different types of ERTEs), giving a bonus at first to those companies whose activity was suspended or limited by the pandemic, subsequently in the transition or desescalada giving a bonus to those companies that they went recovering its activity gradually and with the Royal Decree Act 30/2020 of 29 September encouraging to those companies whose because of reappearance of the pandemic its activity has been limited or suspended.

- Ertes force majeure covid: the percentage of fee exoneration has been gone modifying from the beginning of the state of emergency. To date 30 September one can no longer request the authorisation of an ERTE due to force majeure covid although if it allows extending the ones in force and only you will be able to exonerate those companies that fulfill requirements of the D.To first of the Royal Decree Act 30/2020 of 29 September.

- Ertes ETOP linked to the covid: if they fulfill the requirements established in the D.To first of the Royal Decree Act 30/2020 of 29 September.

- Ertes for impediment of the activity.

- Ertes for limitation of the activity.

How much would have to pay if was not had approved this exoneration?

In the event of ERTE the company continues paying the business part of the contributions of the workers while hard the suspension or the reduction in working hours.

With the exoneration of fees big part of the load is relieved to the companies stopping to pay wages in its entirety or partially (according to the meeting of each worker affected by the ERTE and the type of one ERTE) and taking over the SEPE via the payment of the unemployment benefits to the workers.

During the period established in the ERTE, the company has of paying remunerations or fees of Social Security Institute to its workers?

- During the period set in the ERTE the company does not have to pay remunerations to the hard-working people affected by the suspension. Similarly, in the supposition in which the ERTE contemplates the reduction in working hours, the company only will pay the proportional part corresponding to the meeting carried out.

- For the purpose of the hard-working people, the above-mentioned period will be had as indeed quoted to all intents and purposes.

- The exoneration of fees will be applied by the General Treasury of the Social Security to application form of the company, previous communication of the identification of workers and period of the suspension or reduction in working hours. For the purpose of the control of the exoneration of fees will be enough the verification of that the Public Service of State Employment has proceeded to the examination of the corresponding unemployment benefit for the period of that is discussed. More information in Ministry of Inclusion, Social Security Institute and Migrations.

The administrative silence is considered positive for the ERTES requested starting from 18/03/2020?

Yes, positive is considered. The Royal Decree-Law 8/2020, in its article 22 does not establish no different peculiarity with respect to the regulated thing previously.

There are forms and models of documents for the presentation of the application of ERTE?

Once the E-Office of the Ministry of Labor and Social Economy is entered in the procedure for the presentation of ERTE derived from COVID-19 a small form is opened in registration of application that it owes fill in. Below, the remaining compulsory documents are requested that they should present. For these documents there is no established model, which is why the company can make them as it considers more suitable. In case one is incomplete, during the procedure of the dossier will be requested its subsanación.

The contribution for unemployment of an ERTE for emergency will be taken into account for the calculation of future provisions?

Not, this charge will not be taken into account in the calculation of possible provisions future, will be as though was not had producido.Se establishes the so-called meter to above-mentioned zero in the Royal Decree Act 30/2020 of 29 September.

What effects has the ERTE on the hard-working people?

- The hard-working people affected by the ERTE will have right to the examination of the unemployment benefit, although they lack the period of quoted occupation minimum necessary to it.

- In such cases, the time in which the unemployment benefit of contributory level is received for these ERTE will not count to effects of consuming maximum provision periods legally established.

- Sold out 180 days of unemployment benefit, workers will go on receiving 70% of the benefits base instead of 50% established in the article 270 of the TRLGSS.

- In order to to provide the procedure of the provisions, by the Public Service of State Employment, a staff of application was established collective exhibition of unemployment benefits whose presentation is made via the E-Office of the SEPE by the company, being significant to expedite the payment to the workers by the SEPE and to avoid incidences the review and communication of the correct details of the workers, topcoat the number of updated bank account of each worker. For this reason, the workers affected by the ERTE, they should not present no individual application.

What ERTE you can present via the E-Office of Ministry of Labor and Social Economy?

- Via the E-Office of the Ministry of Labor and Social Economy you can only present the ERTE responsibility of this Ministry. That is, anyone who affect to workers that they provide services in work centres of more than an autonomous community.

- There is an exception: when the ERTE affects to workers that they provide services in work centres of more than an autonomous community, if at least 85% of workers of the staff total belongs to centres at an autonomous community and it there is affected in this Community, this is the competent one for the procedure of the ERTE.

What date of effect have the ERTES that they have its direct cause as a result of the COVID-19?

The date of effect is the date of the application being able to coincide or not with the date of statement of the state of emergency, is when the employer adopts to the decision of suspending contracts or of reducing the meeting, in the communication of the ERTE must fill the start date and of end of the ERTE owing carry out the same communication of start date and end date to the Public Service of State Employment (SEPE) in the certificate of company once approved by the labour authority.

To the ERTE carried out before the publication of the Act Royal Decree 8/2020 of March 18, provided that they are related to the COVID-19, them will be of application this standard?

If, the section 2 of the transitory provision first of the Royal Decree –law 8/2020 arranges that these measures also will be of application to the ones affected by the procedures of contracts and reduction in working hours suspension statements, authorised or initiated, before the coming into force of this Royal Decree-Law, provided that they derive directly of the COVID 19.

If a company has presented an ERTE including to part of the staff and, subsequently, is considered necessary that the ERTE affects to more hard-working/ace for circunstnacias related to the COVID-19, can the company to request the increase of the ERTE initially presented or he owes present an ERTE new because of the rest of workers/ace?

It is not possible to increase the number of workers/affected ace in an ERTE already presented. For this reason, if at first it is not possible to determine the total number of affected and the way in which is going to go applying the ERTE, the company will have to present a second one ERTE.

What happens if the company was closed at the time of coming into force of the State of Emergency and I can not achieve that my workers sign that I have communicated them the presentation of the ERTE?

In that case will be enough the presentation of any document that it proves that the company has carried out that communication, although it is not signed the reception by workers as, for example, an email.

Are owed to include in the ERTE to the workers/ace that are in Temporary Disability?

Yes, because they will happen receivable the unemployment benefit when it finishes its temporary disability situation. This extreme owe reflect in the relationship of hard-working people affected by the ERTE.

Dictated standards for the exceptional situation have not established no specificity for the ERTE with regard to workers that are already found in situation of Temporary Disability . Therefore, is not fitted out nothing extraordinary with regard to this situation. The worker in situation of Temporary Disability already has suspended its employment contract. So far this optionis not fitted out, although we will have be pending if some regulation or development was produced on the situation of workers in Temporary Disability in the companies that they take refuge in the Dossier of Regulation Temporary of Employment. The company maintains the obligation of continuing with the deposit of the financial assistance in fee-paying regime delegate as a result of the compulsory collaboration in the management of the Social Security Institute (article 3.1.to of the Order of 25 November 1966), until the hospital admission.

Unemployment will be paid to all workers of the ERTE?

Yes, all the affected ones will be able to charge unemployment, although they have not paid contributions the minimum period necessary to it.

You can present an ERTE that it groups measures of contract and reduction in working hours suspension?

If, you can present an ERTE that it groups both measures.

I have to unsubscribe to the workers/ace of the company in the Social Security Institute?

During the ERTE is not owed to unsubscribe to the workers in the Social Security Institute, since they follow of registration, regardless of that, in accordance with it considered in the Royal Decree-Law 8/2020, of 17 March, of extraordinary urgent measures to address the economic impact and social of the COVID-19 and subsequent regulatory regulations, so that the company can be disburdened of the payment of the contributions to the Social Security Institute.

Workers included in an ERTE, must request individually the unemployment benefit?

No. The company carries out a collective application of the unemployment benefit for everyone workers included in the ERTE using the model published on the website of the Public Service of State Employment (SEPE).

If a company presented an ERTE for production reasons at the start of the crisis and subsequently have been transformed in force majeure, can modify the ERTE?

Not, it has to desist of the ERTE presented and to present one new due to force majeure. From the official website of the Ministry it is recommended that the withdrawal is communicated via the General Record of the Central Administration.

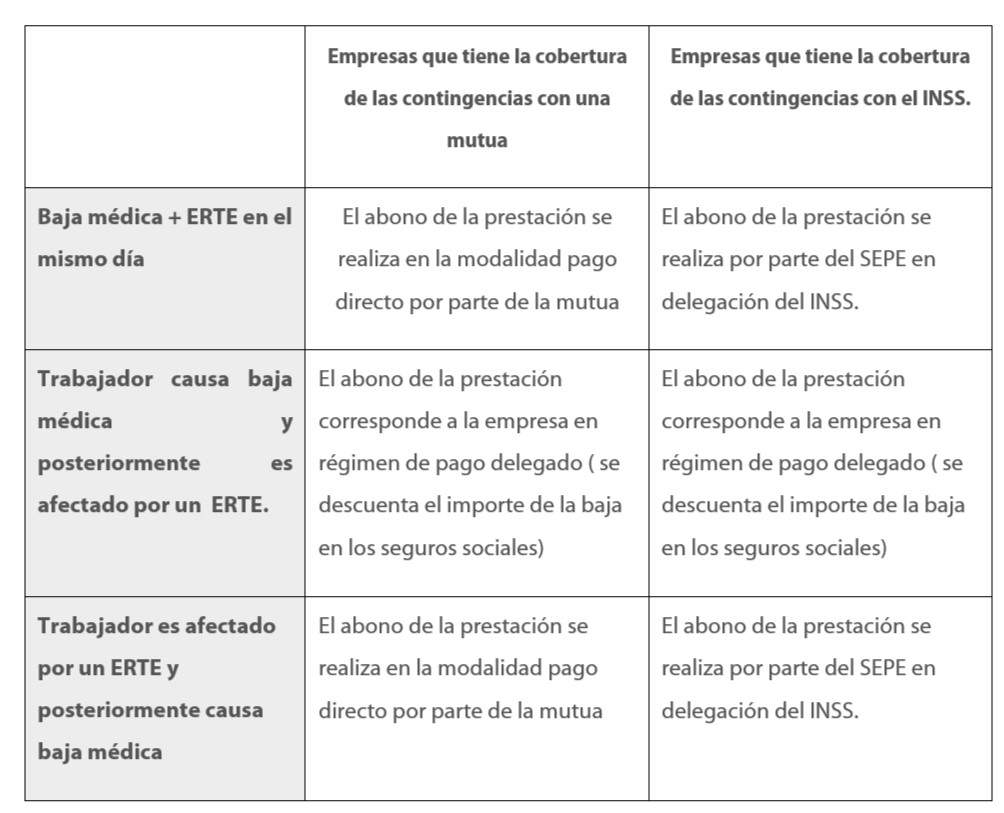

If a worker in the same day cause medical discharge and is affected by an ERTE Whom corresponds the payment of the grant or provision to the worker?

The worker that cause medical discharge on the same day that him affects the date of effects of an ERTE corresponds the deposit of the provision in concept of temporary disability to the mutual society or managing entity with who has cover the contingency.

Chart summary

How affects to a worker of medical discharge and affected by an ERTE the full recovery of the activity?

According to the evolution of the pandemic and of the recovery of the activity, were created for different types of ERTES the types of inactivity, is for this reason that a worker in total suspension of its contract can recover total or partially the activity or meeting that has established in its contract.

For those workers that are in total suspension situation of its contract or of reduction in working hours, are of medical discharge and they are charging the financial assistance by the mutual society in the moment that its type of pass inactivity to full recovery, the financial assistance will receive by the company in fee-paying regime delegate; if the worker returned to the situation of suspension total or initial, the financial assistance would be resumed by the mutual society. You can understand as a simile of the fixed group discontinuous that being of medical discharge in the periods of inactivity (that are initiated in order to campaign) the payment of the provision is made by the mutual society in direct method of payment and in the periods of activity after the call happens receivable by the company in the delegated method of payment.

It is necessary the communication by the company to the SEPE of a worker's medical leave periods?

If, to avoid that the SEPE still pays the unemployment benefit in the periods in which the worker is of medical discharge, the company to overcome month, in the communication of periods of activity via the application certific@2, he owes inform of each day of the month in which the worker is of medical discharge the key 04 “TEMPORARY DISABILITY and maternity days / paternity, excluded of the payment of the provision for this system”.

It is necessary the communication by the company to the SEPE of a worker's medical leave periods?

If, to avoid that the SEPE still pays the unemployment benefit in the periods in which the worker is of medical discharge, the company to overcome month, in the communication of periods of activity via the application certific@2, he owes inform of each day of the month in which the worker is of medical discharge the key 04 “TEMPORARY DISABILITY and maternity days / paternity, excluded of the payment of the provision for this system”.