Novelties ERTE’s introduced by the Royal Decree Act 30/2020, of 29 September

Article 1. Automatic extension of the ERTE due to force majeure

Dossiers of regulation emporal of employment (ERTE) due to force majeure regulated in the article 22. of the Royal Decree-Law 8/2020 and that on coming into force of the Royal Decree-Law 30/2020, 29 September are extended automatically.

Important aspects :

- Before 20.10.2020 will have to formulate before the Public Service of State Employment (SEPE) a collective new application of unemployment benefits for its workers.

- It safeguards of the employment: companies that they extend the ERTE and they benefit from exonerations of the fees will be obliged to maintain the volume of employment during six months more.

- Exonerations of fees: the automatic extension of the ERTE does not involve the to follow applying exonerations of fees.

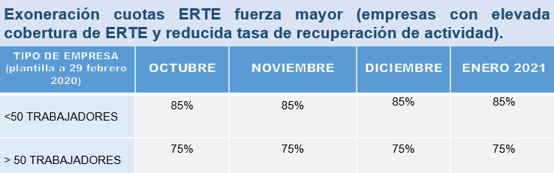

Temporary regulation dossiers of mpleo due to force majeure with exonerations: for those companies whose activity is classed within 42 activities that collects the annexe of the Royal Decree-Law 30 / 2020, of 29 September, or are member of the value chain or shop assistants indirectly of the company whose National Classification of Economic Activities (CNAE) is considered as an activity of high rate of coverage for the ERTE and reduced recovery rate of activity.

Article 2. Temporary regulation dossiers of employment because of impediment or limitations of the activity

Of the ERTE for regulated reappearance in the Royal Decree-Law 24/2020 of 26 June, is taken as a base for two new types of ERTE:

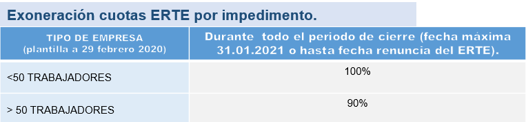

2.1.ERTE for impediment

Applicable to companies of any sector or activity that see prevented the development of its activity in some of its work centres, as a result of new constraints or health containment measures adopted starting from 01.10.2020, previous authorisation of a dossier of regulation storm of employment.

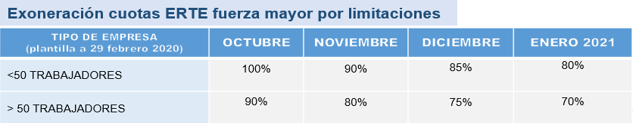

2.2 ERTE force majeure for limitations

Applicable to companies of any sector or activity that see limited the normalised development of its activity (example seating capacity reduction), as a result of new constraints or health containment measures adopted starting from 01.10.2020, previous authorisation of a dossier of regulation storm of employment.

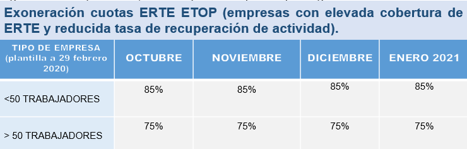

Article 3. The ERTE ETOP (for economic causes, techniques, organisational and of production linked to the COVID-19).

- The ones in force before 30.09.2020

Les will be still applicable in the terms considered in the final communication and until the above-mentioned end in the same one, nonetheless, will fit the extension of an ERTE ETOP that it finishes during the validity of the Royal Decree-Law 30/2020, provided that the agreement is reached for this in the period of enquiries. The extension is not automatic and he owe be processed the temporary regulation dossier of employment before the labour authority receiver of the final communication of the initial dossier.

- The initiated ones from 30.09.2020 until 31.01.2021, them will be of application the article 23 of the Royal Decree-Law 8/2020, 17 March with following specialities

The procedure of an ERTE ETOP will be able to initiate while it is in force an ERTE due to force majeure (according to the article 1 of the Royal Decree-Law 30/2020, 29 September).

When the procedure of an is initiated ERTE ETOP after the completion of an ERTE due to force majeure, the date of effects of the ERTE ETOP will be retrobrought to the completion of the ERTE due to force majeure.

- Exonerations

The ERTE ETOP initiated from 30.09.2020 until 31.02.2021, only will have exonerations if the company has gone of an ERTE due to force majeure to an ERTE ETOP and whose activity is classified in some codes of the CNAE - 09 collected in the annexe of Royal Decree-Law 30/2020, of 30 September. Additionally will have right to exonerations companies that they are qualified such as shop assistants or members of the value chain, and that, also, go from a dossier of regulation storm of employment owing to circumstances out of control to one for economic reasons, techniques, organisational or of production.

First additional provision. Business belonging to sectors with a high rate of coverage for dossiers of employment temporary regulation and a reduced recovery rate of activity

Some profits are established with regard to contribution for those companies belonging according to the annexe of the Royal Decree-Law 30/2020, of 29 September to sectors with high rate of coverage of ERTE and reduced recovery rate of activity, this fee exoneration also members of the value chain or shop assistants companies are applied to be indirectly of the companies above-mentioned such as sectors of reduced recovery rate of activity.

Business members of the value chain or shop assistants indirectly of the companies whose CNAE is collected in the annexe of this Royal Decree-Law:

Member companies are considered of the value chain or shop assistants indirectly of the companies whose CNAE is collected in the annexe of this Royal Decree-Law, those whose invoicing during 2019, has been generated in at least 50%, in operations carried out in a direct way with companies or its actual activity depends indirectly of the developed indeed by companies included in the codes CNAE of the annexe of this Royal Decree-Law.

The application of company statement shop assistant or member of the value chain owe be presented between days 5 and 19 October 2020 and will be processed and it will solve in accordance with the following procedure:

- The procedure will be initiated through application of the company before the labour authority that would have dictated the resolution expresses or demitasse of the dossier of employment temporary regulation extended, to that which will be accompanied of a report or explanatory report of the confluence, and where applicable, of the corresponding supporting documentation. The company must communicate its request to workers and send the prior report and supporting documents, if any, to the workers' representatives.

- The resolution of the labour authority will be dictated within five days to be told from the presentation of the application, previous report application of the Work and Social security Inspectorate, and he owe limit to confirm the condition of member company of the value chain or shop assistant indirectly, in the defined terms for this additional condition. Elapsed the above-mentioned term without has relapsed resolution expresses, the company will be able to understand estimated the application presented by administrative silence.

- The report of the Work and Social security Inspectorate will be evacuated in the term improrrogable of five days.

Procedures before the SEPE (important aspects):

Starting from 01.10.2020 so much for the new ones ERTE (during the first 15 business days since is authorised the ERTE or after resolution estimatoria for silence office worker) as for the ERTE extended already in force (before 20.10.2020), so much if these have access to exoneration of fees or not, it is necessary to carry out the collective provisions application before the SEPE (in the set up staff for this and available on the website of this organisation) via the E-Office of the SEPE. It is significant this procedure so that the hard-working people can charge unemployment benefits.

Cancellation in unemployment benefits : the communication of the cancellation in the provision of unemployment of workers both temporary and definite, will be communicated via the file XML, of activity periods communication. If the cancellation has been communicated via the file Excel or for another middle and the SEPE continues paying the provision to the hard-working people, you can study again via the staff of the periods of activity.

Activityperiods staff: to overcome month (of the 1 at 20 of each month) will be owed to send the staff with periods of workers activity; for anyone who have caused cancellation in the unemployment benefit for recovered credit in its entirety the meeting that had established in its contract, is not necessary to inform in the staff of activity until they do not return to be affected by ERTE.

If the information of the staff's activity is had in the current month worker during that month, you can inform in that month in actual and are even permitted two staffs in the same month (example can inform to overcome month of the activity of the previous month and in another staff of the activity that they are going to have of the current month if I have this information).

To provide calculations of the days of activity and to generate the file XML that will be owed to send via the certific@2, the SEPE makes available in its website a help wizard.

This XML generator, takes into account the hours of the usual meeting that has the hard-working person for contract, indicating every day non worked hours, gives the result of total days of NOT ACTIVITY that they are days of unemployment that it will pay as a provision the SEPE.

Communication of the modifications in the calendar and work schedule : companies should communicate with previous character for the activity inspector, modifications in the calendar and work schedule (article 298 TRLGSS and MINISTERIAL DECREE ESS 982/2013), is information that is sent to the SEPE via its e-Office but is information destined for the Labour inspectorate, with this information before visits to the companies can check what workers because of schedule and calendar must be in the work centre.

Significant: before the Royal Decree-Law 24/2020 of June 26, for every variation companies owed communicate the staff of cancellation communication, the collective provisions application and the staff of activity periods.

After the Royal Decree-Law 24/2020 of 26 June, for every variation only is necessary the shipment of the staff of periods of activity.

Exemptions from Social Security contributions in Companies in the Tourism, Hospitality and Trade sectors (COVID-19)

We attach relevant information included in the ROYAL DECREE-LAW 36/2020 and the newsletter of network news 21/2020, with regard to the sectors of tourism, hospitality industry and trade.