FAQs

It is compulsory to contribute the model 145 in these new provisions?

Yes, since has been changed of fiscal year.

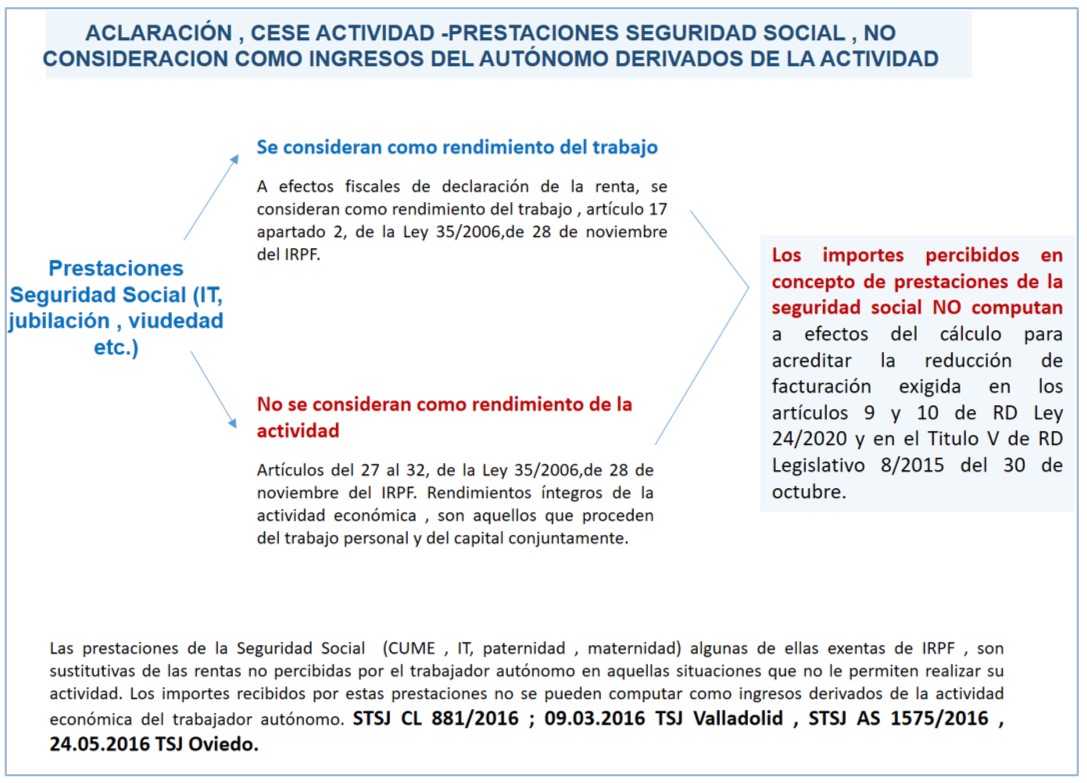

If as person self-employed worker am receiving an IPT, must take into account these incomes?

Not, those incomes are yields of work, are not owed to take into account to calculate the reduction of the incomes in these provisions.

How justify the reduction of the invoicing if in 2019 paid taxes for modules (model 131) and in 2020 tax contribution for direct estimate (model 130)?

Contributing the necessary documentation. If you pay taxes for modules will be able to you to him to request the book of income record/sales and expenses/purchases, and if you pay taxes for direct estimate the model 130.

How justify the reduction of invoicing if tax contribution for objective evaluation, modules (model 131), and I have received provisions for cessation of activity mentioned in the ROYAL DECREE-LAW 8/2020, 24/2020 and 30/2020?

For the purpose of accreditation of the requirement of reduction of the invoicing to that which advert articles 17 Royal Decree-Law 8/2020, of 17 March, 9 Royal Decree-Law 24/2020, of 26 June, and the ADDITIONAL PROVISION 4th Royal Decree-Law 30/2020, of 29 September, it will be understood that the people self-employed workers that they pay taxes for objective evaluation have experienced that reduction provided that the workers' daily average number members in registration to the Social Security System in the corresponding economic activity, expressed to four digits (CNAE), during the period to that which corresponds the provision, be inferior in more than 7.5 per cent to the daily average number corresponding to the second half of 2019.

Clarification: provisions 8/2020, 24/2020 and 30/2020 yields of the activity are not considered, but instead yields of work.

If tax contribution for objective evaluation and I do not have workers in charge, how you can check if I fulfill the condition of the reduction of accountable incomes in the first half of 2021 of more than 50% with respect to the had in the second half of 2019, if they do not go because of incomes and expenses?

For these provisions is not taken into account to have workers in charge or not, but instead the decrease of members in registration to the Social Security System in the corresponding economic activity.

As an example put a cab driver that it pays taxes for modules and sees affected its activity: It will not have to prove its income reduction, but instead that subsequently will be had to check that the number of affiliated person has been reduced at least 7.5 per cent to the daily average number corresponding to the second half of 2019.

If I am of medical discharge, will be able to request the provision once has the registration?

He owes present the application within the prescribed time for this, independently that is of medical discharge. When the provision is recognised, will be paid starting from the next day of the hospital admission, as long as it has presented the application in term.

What are accountable incomes fiscally of the activity on a self-employed basis?

They are incomes that are declared in the models of inland revenue 303 and 130/131.

In the provisions for cessation of activity of people self-employed workers for suspension of the activity is stipulated as an incompatibility the “perception of yields from the society that has suspended the activity”. I can then to request some collected provisions in the articles 5 and 6?

Not, in the articles 5 and 6 is stipulated as an incompatibility “the perception of yields from the society that has suspended the activity”. The company person that receives salary will not be able to request the provision for receiving yields of work.

I can request the collected provision in the article 7?

Yes, taking into account that the reduction of invoicing of the person company in the event of receiving salary, is of the society.

If the company freelance person bill, the reduction of invoicing is applied to the freelance person (yields of the activity). On the other hand, if the person self-employed worker societarioarecibe salary (earned incomes), the reduction of invoicing will be applied to the society.

If have received some grant of Autonomous Communities, is considered as a deposit in these provisions?

Grants received are yields of the activity, but not imputable to the calculation of the reduction of invoicing.

As person self-employed worker company, how justify the reduction of incomes? And if the society has not had incomes, but still charge my salary?

The company person self-employed worker charges for its services via salary (that it pays taxes such as earned incomes) or it is obliged to issue bill according to functions and shares in the society and the activity that it carries out in her, if its activity is integrated in the one made by the company (salary) or if its activity is another professional (whose relationship would already be client –supplier), which is why it corresponds to issue bill.

The classification comes given by Act of the PERSONAL INCOME TAX of effects 1 January 2015 (article 27.1) and rinsed through the Criterion of the Directorate General of Tax contributions. In fact, the contribution of the person worker autónomavsocietaria is not linked to the MINIMUM WAGE but instead to the General Statute of Budgets of the State.

In short, if the activity is considered as an earned income, the company person self-employed worker can charge salary, but if deposit of the economic activity is considered (occupation) the company person self-employed worker owes turn over to the society.

From 1 January 2015, day in which enters vigor the tax reform, incomes of economic activities will be considered (occupations), instead of incomes of work, the obtained ones for services rendered by people members workers of its societies, provided that these two conditions are fulfilled at the same time:

- They carry out qualified as professional activities by the Tax Agency (these activities are the included in the section second of the fares of the IAE).

- They are included in the Special Regime of Self-employed workers (RETA) or an alternative mutual society.

For the people members that they have more than 50% of the effective control of the stock and it carries out functions of control, management of the society, only will be able to charge for salary if it comes collected in the statutes of the society and it does not have an organisational structure (own means) without needing to use that one of the society.

For members and members that they have less than 50% of the effective control of the stock only will be able to consider earned income and to charge through salary if its services are administrative and its activity is not collected in the section second of the fares of the IAE.

Which is why it is concluded that, if the company person self-employed worker bill, the reduction of invoicing is applied to the person self-employed worker (yields of the activity). On the other hand, if the the company person self-employed worker receives salary (earned incomes), the reduction of invoicing is applied to the society.

If am person manager of two societies with different activities, have to take into account both companies' financial details for complying with the requirements of invoicing and net yield?

Yes, it is had to take into account both companies' financial details and to comply with established requirements.

If the suspension of my activity is prior to 1 February 2021 and it has already passed the term to request the provision of Pecane Suspension of the article 13, can request the provision Pecane Suspension of the article 5?

For the transitory provision second, the person self-employed worker has be receiving the provision on 31 January 2021. If the application has been presented late and you can not retrobring to the date of the next day to the suspension because they have exceeded 15 business days, the application will will be rejected for being late.

We locate him, in that case, to request another provision as that one of articles 6 or 7 (Pecane Lack or POECATA3). It will not be able to access neither to that one of article 5 if the suspensory standard is prior to the coming into force of the ROYAL DECREE-LAW 2/2021.

If start to to carry out home service, take away or I install terrace (or constraints have finished), must give up to the provision of Pecane Suspension and to return her entire or the same one finishes in the date that it indicates? And I will be able to request then the provision of POECATA3, article 7?

If it initiates activity before the uprising of the suspension in writing, he owe communicate the date of restart of the activity, moment in which the financial assistance will suspend him to him. Similarly will enjoy the exoneration of the provision until the last day of the next month to restart the of the activity.

Once restarted the activity, will be able to request another provision of the ROYAL DECREE-LAW 2/2021 if you fulfill demanded requirements for this provision.

If me dedicate on sale traveling in different municipalities, which have suspended all activity less the essential thing, and in some municipalities stops being suspended the non-essential activity, will stop being person payee of the provision of Pecane Suspension?

If you restart your activity in some municipalities through which had you to him recognised the provision in writing should inform the date of restart of the activity, moment in which the financial assistance will suspend you to him. Similarly will enjoy the exoneration of the provision until the last day of the next month to restart the of the activity.

Once restarted the activity, will be able to request another provision of the ROYAL DECREE-LAW 2/2021 if you fulfill demanded requirements for this provision.

If I have more than an activity and one theirs is not suspended, can request the provision of Pecane Suspension?

NOT, he owes have all suspended activities.

If I am receiving the provision of Pecane Suspension of the article 13.1 from January and the suspension ends in February, can request the POECATA3 starting from 1 February?

Not, will receive the provision of Pecane Suspension until the end of February and subsequently, would receive POECATA3 starting from March. The renunciation to the provision of Pecane Suspension supposes the refund of the entire provision.

If am person company self-employed worker and I pay contributions for the minimum base for my activity, what amount will receive of the provision Pecane Suspension?

It will receive 50% for the minimum Contribution basis of 944.40, but it will pay contributions as person self-employed worker company.

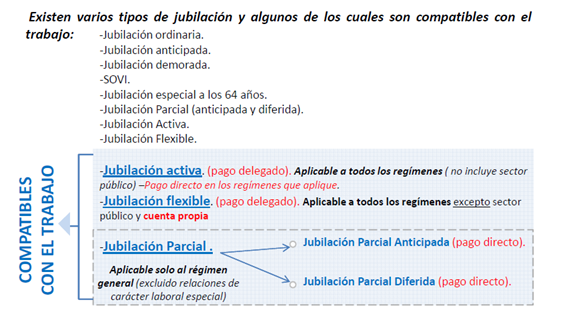

I can access the provision of Pecane Suspension if I am in active retirement situation?

Yes, although he owe prove that it is retired asset.

The consumed period of the provision Pecane Suspension and Lack, articles 5 and 6, will reduce future charge periods of the provision of cessation of activity?

The time of perception of these provisions will not reduce periods of provision for cessation of activity to those which can have right in a future.

If I have already consumed quoted months for cessation of activity, can request the provision of Pecane Lack?

Yes.

If only me are two months of contribution for the POECATA3, would be able to request subsequently Pecane Lack when having consumed?

Yes, will be able to request the Pecane above-mentioned Lack in the article 6.

If I am receiving the Pecane Lack and my provision is extinguished for fulfilling during its perception the period of lack, can request the POECATA3?

Yes, if it is receiving the Pecane Lack and it fulfills requirements of lack during the perception of the provision, this you can extinguish of voluntary way and it will be able to request the POECATA3, or to follow receiving that one of Pecane Lack until 31 May.

If I am receiving the Pecane Lack and my provision is extinguished for fulfilling during its perception the period of lack, the perception of the provision of the POECATA3 is automatic?

Not, when being a different provision, when extinguishing this provision, in this case for not fulfilling the required lack, you must study the application of the new provision (POECATA3). The Mutual Society can not process voluntarily new provisions, since he owes exist an application by the concerned individual.

If I registered me as person self-employed worker on 1 January 2020, and I comply with 12 months of lack on 01 February 2021, what halves or quarters will be used for the checkout of the decrease of the invoicing, in the provision of Pecane Lack, since the second half of 2019 there is not no invoicing?

If it does not have activity in 2019 you can not do the comparison, so that it does not fulfill the requirement to access this provision. Therefore it, he owe consult the possibility of requesting the collected provision in the article. 6.

If I do not fulfill requirements of invoicing of the POECATA3 and am person self-employed worker with lack, can request the Pecane lack?

Yes, as long as it fulfills the requirements established in the article 6.

I am a person self-employed worker that in 2019 had an activity and in 2021 have changed to another different. How will compare the reduction of incomes in this case in the provision of POECATA3?

To access this provision owes maintain the same activity in the periods to compare. If it has changed of activity so that you can not carry out the comparison does not fulfill the requirement to access this provision, so owe consult the possibility of requesting the collected provision in the article 6.

Access summary chart to the collected provision in the article 6.

What should contribute if as person self-employed worker fulfill the ordinary retirement age and I am receiving a provision of cessation of activity linked to Covid?

If I have reached the ordinary retirement age must contribute to the Mutual Society the report of retirement simulation of the INSS to prove that I do not have access to the retirement pension owing to lack of lack.

Only the total retirement is incompatible with the provision of POECATA3.

If I am receiving the provision of POECATA3 until 31 of May 2021 and me unsubscribe subsequently in the RETA, will be able to request the ordinary cessation?

Yes, but he owe calculate the time that it is him not consumed of other provisions.

If I have not had incomes in the second half of 2019. I i correspond receiving the provision of POECATA3?

Not, since there is no period of comparison.

If I registered me in the RETA on 01 December 2019. you can calculate the reduction of incomes to request the POECATA3?

Yes, since the reduction of incomes will be calculated with the proportional period that it has been of registration in the second half of 2019 with the first half of 2021.

I am a person self-employed worker with 50% of share in a Joint assets. I can access the provision of POECATA3?

Yes. On one hand, to access this provision is demanded to prove in the first half of 2021 a reduction of accountable incomes fiscally of the activity on a self-employed basis of more than 50% of the had in the second half of 2019; as well as not obtained credit during the indicated half of 2021 some accountable net yields fiscally higher than 7,980 euros. And for another, the joint assets pays taxes as a company in power of incomes in accordance with the regulated special scheme in the Section 2nd of the X Title of the LIRPF, and the civil society pays taxes via the corporation tax. As comunero also it is necessary to give expenditure account and community incomes in a quarterly way through the Model 130 or the Model 131. Therefore, for the purpose of this provision independent freelance person is considered and it will have right to the same one.

If I fulfill all requirements to access the provision of POECATA3, but I have reasoned to go through or to stop in April my business, can receive this provision?, and how long? I should return the provision for not fulfilling requirements until on 31 May 2021?

If it goes through or it closes the business, stops having activity, which is why it will stop having right to the provision from the day that is unsubscribed com freelance person.

I am person collaborative familiar self-employed worker can request the provision of POECATA3?

Yes, if it complies with all the requirements established in the article 7.

If as person self-employed worker registered me in the RETA and I started to pay contributions for the WINETASTING on 1 April 2020 and I do not fulfill 12 months of lack until 1 of April 2021, would be able to request the Pecane Lack for months of February and March, and later on to request the POECATA3 from 1 April?

Not, it will have to request the Pecane Lack for everything the period, when not having lack nor possibility of comparing the reduction of the second half's incomes of 2019.

How person self-employed worker have credit registration state in the RETA in order to be able to receive the provision of PETECATA3?

Yes, I have credit registration state in RETA in the periods that it indicates the article 8 of ROYAL DECREE-LAW 2/2021, from 1 January 2018. That is, minimum 4 months and maximum 6 months in each of the years 2018 and 2019, and at least two of these months between January and June of each one of the years.

How self-employed worker and member person of a cooperative have right to receive the provision of PETECATA3?

Yes, as long as it fulfills the requirements established in the article 8.