Cessation of activity starting from 01 January 2023

The Royal Decree-Law 13/2022, of 26 July, establishes improvements in the protection for cessation of activity of leste group. For this reason, according to the date in which has stopped in its activity will be of application or not introduced legislative changes for this standard whose coming into force is starting from 1 January 2023.

What basic conditions have to fulfill to access the provision?

- Be member and in registration in the Special Plan for Self-Employed Workers and Freelancers or in the Special Plan for Sea Workers.

- Have covered the minimum period of contribution for cessation of activity (at least 12 quoted months in 24 previous months to the situation of cessation).

- Find in legal situation of cessation of activity (cancellation in the Special Regime, except for for the reasons for epigraphs 4th and 5th of the article 331.1.a) and the reasons for force majeure total and partial storm).

- In the event of definite cessation, not fulfilled credit the ordinary age to cause right to the contributory pension of retirement, unless the self-employed worker did not have accredited the period of required contribution for this.

- Find aware of payment of fees to the Social Security Institute.

- Be registered with the Public Employment Service.

- For the suppositions of the epigraphs 4th and 5th of the 331.1.a) the self-employed worker will not be able to practice another activity unless the self-employed worker is found in situation of multiactivity at the time of the fact responsible for the provision for cessation of activity, that it will be compatible with the perception of the compensation package for the work as an employee that was come developing, as long as of the sum of the monthly remuneration average of the last four months immediately prior to the birth of the right and the provision for cessation of activity, result a monthly average amount lower than the amount of the minimum wage in force at the time of the birth of the right

- If it has workers to its charge, will owe, previous to the cessation, to fulfill guarantees and regulated obligations and procedures in the employment law.

In what consists the provision?

The system of cessation of activity protection understands following provisions:

- The financial assistance for cessation, storm or definite, of the activity.

- The deposit of the contribution to the Social Security Institute during the perception of the financial assistance for cessation of activity.

If are self-employed worker Why reasons can request the provision?

Will be found in legal situation of cessation of activity all the self-employed workers that they stop in the exercise of its activity for some following causes:

- For the confluence of economic reasons, technicians, productive or organisational determiners of the inviabilidad of continuing the economic activity or professional (in the event of open establishment to the public its close will be demanded during the perception of the grant or its transmission to third parties), when it arises some following circumstances:

- Economic reasons. It is shown off that exists inviabilidad to continue with the activity, when it has losses higher than 10% of incomes, obtained in a complete year, and excluded the first beginning year of the activity.

- Administrative or judicial executions, that they tend to the charge of debts, recognised by the executive bodies, that they involve, at least, 30% of incomes of the activity of the self-employed worker, corresponding to the immediately previous financial year.

- Judicial statement of contest, that it impedes to continue with the activity, in the terms considered in the Act 22/2003, of 9 July.

- The reduction of 60 per cent of the meeting of all people in situation of registration with obligation of paying contributions of the company or temporary suspension of employment contracts of at least of 60 per cent of the number of individuals in situation of registration with obligation of paying contributions of the company provided that the two previous fiscal quarters to the presented application before the Tax administration, the ordinary entry level or sales has experienced a reduction of 75 per cent of the ones registered in the same periods of the exercise or previous years and the self-employed worker's monthly net yields during those quarters, for all the economic activities, business studies or professionals, that it develops, do not reach the amount of the minimum wage or that one of the base through which came paying contributions, if this was inferior. In such cases will not be necessary the close of the open establishment to the public or its transmission to third parties.

- In the event of self-employed workers that do not have wage earners, the maintenance of demandable debts with creditors whose amount exceeds 150 per cent of common receipts or sales during the two previous fiscal quarters to the application, and that these incomes or sales in turn suppose a reduction of 75 per cent with regard to the one registered in the same periods of the exercise or previous years. For this purpose debts will not be counted that for non-compliance of its obligations with the Social Security Institute or with the Tax administration maintains. Will be demanded also that the self-employed worker's monthly net yields during those quarters, for all economic activities or professionals that it develops, do not reach the amount of the minimum wage or that one of the base through which came paying contributions, if this was inferior. For this purpose debts will not be counted that for non-compliance of its obligations with the Social Security Institute or with the Tax administration maintains. In such cases will not be necessary the close of the open establishment to the public or its transmission to third parties.

- Force majeure, determiner of the cessation storm or definite of the activity. It will be understood that there are reasons for force majeure in the temporary cessation partial when the interruption of the company's activity affects to a sector or work centre, exist a statement of emergency adopted by the competent public authority and a fall of incomes is produced of 75 per cent of the activity of the company in connection with the same period of the monthly previous year and incomes of the self-employed worker not extent the minimum wage or the amount of the base through which came paying contributions if this was inferior.

- Administrativelicence loss, provided that it constitutes a requirement for the exercise of the economic activity or professional, and it does not avenge motivated by the fee of penal offences.

- Violence of gender, determiner of the cessation storm or definite of the activity of the self-employed worker.

- Marriage separation divorce or agreement, as long as familiar assistance functions are practiced in the business of the former spouse.

If are TRADE (person self-employed worker economically dependent), Why reasons can request the provision?

- Ending of the contract.

- Serious breach by your customer.

- Justified or unjustified termination by your customer.

- Because of the death, disability or retirement of your customer.

If are member work cooperative worker partner, Why reasons can request the provision?

- For inadmissible expulsion of the cooperative.

- For economic reasons, techniques, organisational, productive or of force majeure.

- For completion of the period to that which the company link of certain duration was limited.

- Because of gender or violence violence sexual, in the hard-working members.

- For loss of administrative licence of the cooperative.

- Candidates to members in probationary period that they would have stopped in the provision of work during the same one for unilateral decision of the Board Vice-chancellor or corresponding administration body of the cooperative.

If are manager or member of a corporation, Why reasons can request the provision?

To access the provision, owes credit stopped unintentionally in the position of adviser or manager of the society or in the provision of services to the same one and that the society has incurred in losses in a complete year higher than 10% of incomes or it has decreased its net worth under two parts three of the figure of the share capital.

What term have to present the application of the provision?

The term of the application finishes the last day of the next month in which the cessation of activity has been produced.

Nonetheless, in the applications for economic reasons, technicians, productive or organisational, of force majeure, for violence of gender, sexual violence, for willpower of the client, founded in justified cause and because of death, disability and retirement of the client, the term will begin starting from the date that has been done to appear in corresponding documents that prove such situations' confluence.

What documentation must contribute?

With general character following documents:

- Photocopy of the NATIONAL ID NUMBER, ID number, Passport, NIE (to both faces) in force.

- Model 145 PERSONAL INCOME TAX Data communication to the payer, completed, date-stamped and signed. Exception: Basque Country, Navarre

- Fee-paying supporting document photocopy of its contributions of the last ones 2 months

- Activity employment demand or commitment subscribed before the Public Service of Employment

- Requested credit supporting document the cancellation in the corresponding Special Regime

- If there is deferment of fees pending payment to the TGSS: resolution of the General Treasury of the Social Security, of the deferment of the fees pending payment, and monthly verification slips of the payment and I fill of prescribed times in the same one

- Census statement of cancellation of the holder of the activity (Model 036 or 037).

- Form specific to application of the provision of cessation of activity by self-employed workers according to the requested provision.

- Declaration of Responsibility and/or guarantee and obligation statement on compliance according to the requested provision.

- Specific documentation that proves the right to the requested provision (to see detail in every application form).

What happens if I present the application of the provision out of the prescribed period?

In the event of presentation of the application once elapsed the term set in the previous section, and provided that the self-employed worker complies with the rest of the legally planned requirements, will be discounted of the period of perception days that they mediate between the date in which would owe presented credit the application and the date in which presented it.

When is born the right to the provision? Examination and birth from the right to the provision

The right to receive the of the provision, for the confluence of economic reasons, technicians, productive or organisational, will be born on the following day to that in which has effects the cancellation in the Special Regime to that which were assigned, with following exceptions of the article 331 of the Social Security Act:

- In cases of cessation of activity considered in the article 331.1.a). 4.th, given that it does not proceed the cancellation in the regime of Social Security Institute corresponding, the right to receive the will be born the beginning of the month next on the communication to the labour authority of the business decision of reduction of 60 per cent of the working day of all the workers of the company, or to the temporary suspension of employment contracts of 60 per cent of the staff of the company.

- In the suppositions to that it adverts the article 331.1.a). 5.th, when not proceeding neither the cancellation in the corresponding special scheme, the right to receive the will be born the beginning of the month next on that one of the application.

In the alleged force majeure, the birth of the right the day will be produced in which is accredited the confluence of the force majeure via opportune documents.

The right to receive the of the provision for the rest of regulated suppositions (administrative licence loss, violence of gender and sexual, because of divorce or marriage separation), the beginning of the month next on that which have effects the cancellation as a result of the cessation of activity.

Which is the amount of the provision that I will receive?

The benefits base of the provision will be determined as the average of the contribution bases out of the 12 months continuing and immediately prior to the legal situation of cessation of activity.

In the Special Plan for Sea Workers the benefits base will be calculated on all the contribution basis for this contingency, without application of the coefficients proofreaders of contribution, and also, periods of compulsory veto approved by the statutory authority will not be taken into account for the computation of the period of 12 continuing months and immediately prior to the legal situation of cessation of activity, as long as in those veto periods was not had perceived the provision for cessation of activity.

The amount of the provision, during everything its period of enjoys, will be determined applying to the benefits base 70 per cent, except for in the suppositions considered in epigraphs 4.th and 5.th of the article 331.1.a) and in cases of partial temporary suspension owed to force majeure, where the amount of the provision will be of 50 per cent.

These provisions, except for for the suppositions of the epigraphs 4th and 5th and the partial temporary suspension, are subjects to the limits of the Public Indicator of Multiple Effects Income (PUBLIC INDICATOR OF MULTIPLE EFFECT INCOME).

For how long will I receive the benefit?

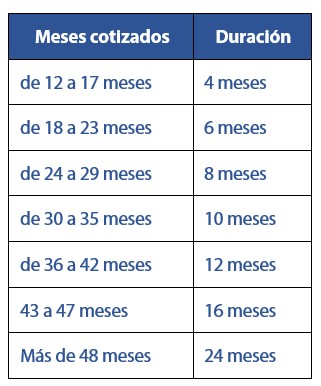

The duration of the provision for cessation of activity will be according to periods of contribution made within forty-eight previous months to the legal situation of cessation of activity of which, at least, twelve months must be realised in twenty-four months immediately prior to this cessation situation according to the following scale:

The self-employed worker to that which has him to him recognised the right to the protection economic by cessation of activity will be able to return to request a new examination, provided that they arise legal requirements and they have passed eighteen months from the examination of the last right to the provision.

How works the contribution during receive the of the provision?

The body manager will be done person responsible for 100% of the contribution of self-employed workers while it lasts the situation of cessation of activity, with the exception of the suppositions considered in epigraphs 4.th and 5.th of the section 1.a) of the article 331, where the body manager will pay, together with the provision, 50% of the fee, being the person self-employed worker the person responsible for the deposit of all contributions to the Social Security Institute.

This contribution basis will be matched the benefits base of the provision without, in no case, the contribution basis can be lower than the amount of the minimum base or only base of contribution considered in the corresponding regime.

In cases of violence of gender or the sexual violence determiner of the cessation storm or definite of the activity of the self-employed worker or it will exist the obligation of paying contributions to the Social Security Institute.

The body manager will take over of the fee of Social Security Institute that it corresponds him during the period of perception of the provision, provided that has been requested in the legal period planned for every situation. In another case, the body manager will take over starting from the day first of the next month to the one of the application.

They can suspend me the provision of cessation of activity?

You will be able to suspend for the following reasons:

- During the period that it corresponds for deposit of sanction for slight or serious offence, in the terms established in the legislative law of the Act on Offences and Sanctions in the Social Order.

- During the fulfillment of condemnation that involves hardship of freedom.

- During the period of performance of a work on a self-employed basis or as an employee, except for in cases of cessation of activity considered in epigraphs 4.th and 5.th of the article 331.1.a), or of partial temporary cessation of the activity derived from force majeure, that they will be compatible with the activity that cause the cessation, in the terms considered in the article 342.1 without prejudice to the extinction of the right to the protection for cessation of activity in the supposition established in the article 341.1.c).

In the event of suspension, the self-employed worker will be obliged to request the resumption once completed the cause that motivated the suspension.

When the provision of cessation of activity is extinguished?

Will be extinguished for the following causes:

- For exhaustion of the term of duration of the provision.

- For deposit of sanctions in the terms established in the legislative law of the Act on Offences and Sanctions in the Social Order.

- For performance of a work on a contract or freelance during a time equal to or more than twelve months, in this last case provided that it generates right to the protection for cessation of activity as a self-employed worker.

- For fulfillment of the ordinary retirement age or, in the case of classed freelance workers in the Special Plan for Sea Workers, theoretical retirement age, except for when they do not meet requirements to access the contributory retirement pension. In this supposition the provision for cessation of activity will be extinguished when the self-employed worker complies with the rest of requirements to access this pension or it runs out the term of duration of the protection.

- For examination of retirement pension or permanent disability, without prejudice to that established in the article 342.1.

- For relocation from residence to the foreigner, except for in the cases that in accordance with the regulations are determined.

- For renunciation volunteer to the right.

- For death of the self-employed worker.

Which are incompatibilities with the provision of termination of activity of self-employed workers?

The perception of the financial assistance for cessation of activity in the self-employed workers is incompatible with:

- The work on a self-employed basis, although its performance does not involve the compulsory inclusion in the Special Regime for Own Account or Self-employed workers or Special Plan for Workers of the Sea, as well as with the work as an employee.

- The acquisition of pensions or financial assistance of the Social Security Institute, unless they have been compatible with the work that caused the provision for unemployment, as well as with measures of promotion of the cessation regulated by standard sectorial for different communities, or those which can regulate in a future with state character.

- The perception of aids for the paralysation of the fleet with respect to freelance workers included in the Special Plan for Sea Workers.

- The work as an employee, unless the perception of provision for cessation of activity avenges determines for the willing thing in the epigraphs 4.th and 5.th of the article 331.1.a), or for cessation storm partial of the activity derived from force majeure, that they will be compatible with the activity that causes the cessation, provided that obtained monthly net yields during the perception of the provision are not higher than the amount of the minimum wage or to the amount of the base through which came paying contributions, if this was inferior.

Special situations

If initiate a cancellation for temporary disability (TEMPORARY DISABILITY), the provision that you will receive will be the same one that were receiving for cessation of activity. Nonetheless, the time that are of cancellation for TEMPORARY DISABILITY will discount you to him of the period of perception of the provision for cessation of activity.

In the case of cancellation because of birth and care of smaller, the provision that you will receive will be that which corresponds for this contingency and will not discount you to him of the period of perception of the provision for cessation of activity.

Access the forms to apply for the benefit