Review of the extraordinary cessation of activity benefit for self-employed workers (PECANE 2.4)

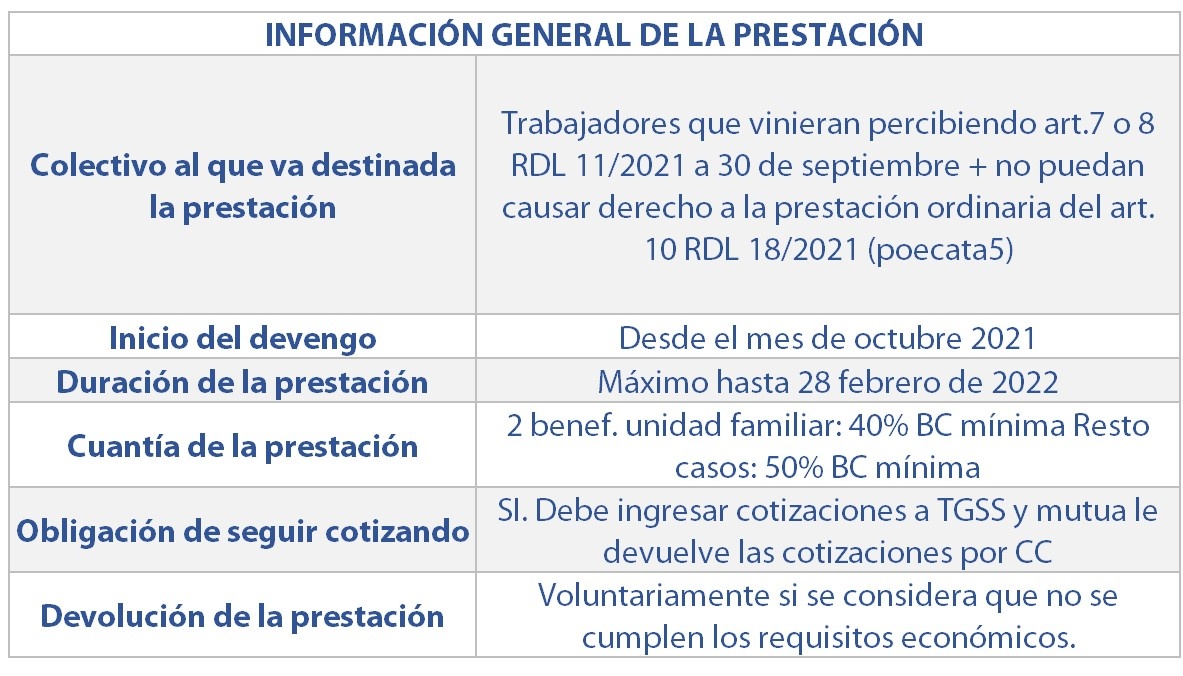

Review of the extraordinary cessation of activity benefit for self-employed workers who were actively working and, as of 30 September 2021, were receiving any of the cessation of activity benefits provided for in Articles 7 and 8 of Royal Decree-Law 11/2021, of 27 May, on urgent measures for the protection of employment, economic reactivation, and the support of self-employed workers, and who are not eligible for the ordinary cessation of activity benefit provided for in Article 10 of this Royal Decree-Law.

Laid out in Article 11 of Royal Decree-Law 18/2021 of 28 September, on urgent measures in defence of employment, economic recovery and the strengthening of the job market.

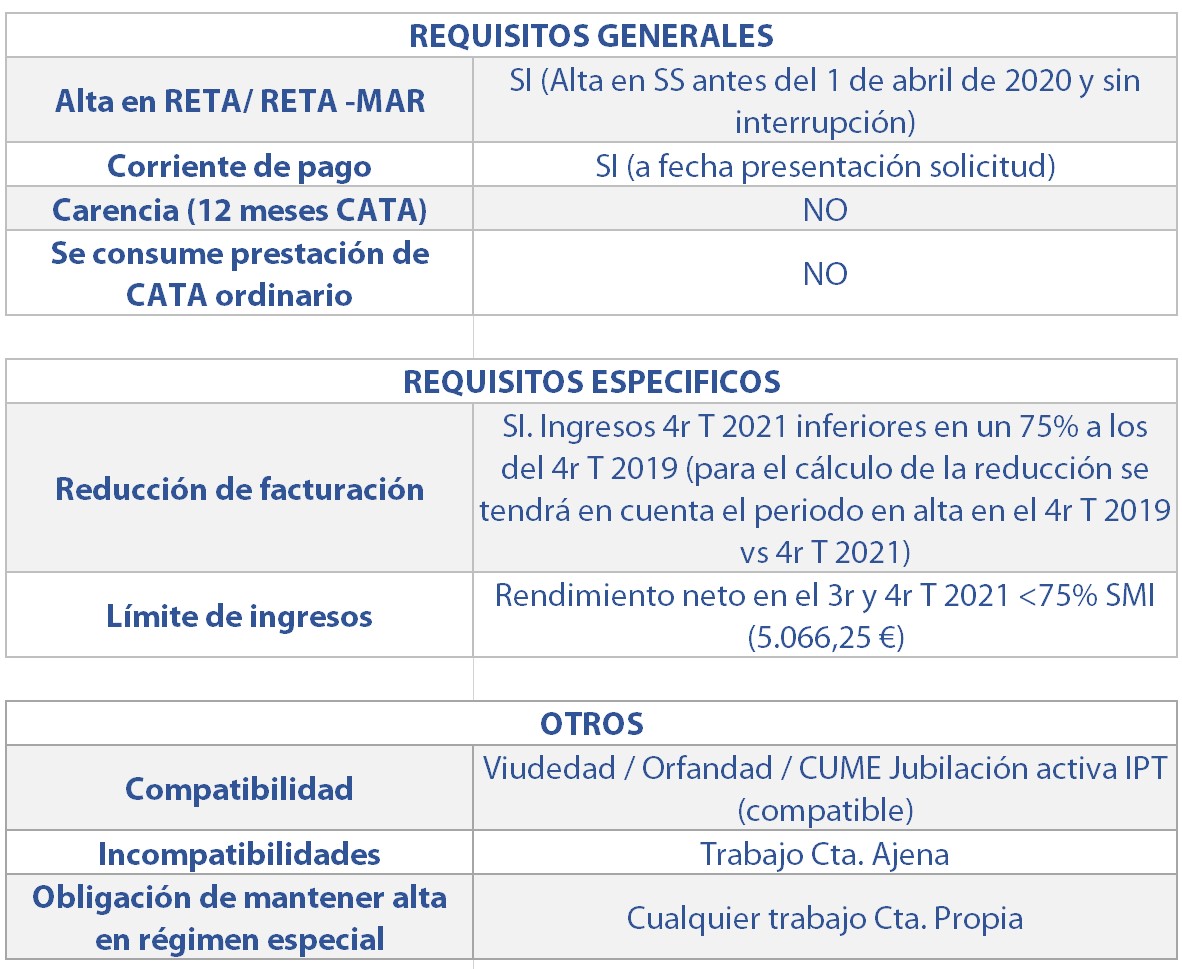

The self-employed worker must meet the following requirements:

- Have received the PECANE 2.3 or POECATA 4 benefit provided for in Articles 7 and 8 of Royal Decree-Law 11/2021. If during the process of procedure opening of audience, the worker has presented previous claim against one of those provisions, he owe attach the agreement of acceptance of the previous claim by Mutua Universal.

- Be registered and up to date with contributions in the Special Regime for Self-Employed Workers or in the Special Regime for Sea Workers as a self-employed worker since before 1 April 2020. Nonetheless, if in the date of the presentation of the application the requirement of being was not fulfilled up to date in the payment, the self-employed worker has a term of thirty calendar days for made credit the payment.

- In the case of self-employed workers who have one or more employees, compliance with all labour and Social Security obligations must be demonstrated at the time of applying for the benefit by submitting a certificate of up-to-date payment for the Contribution Account Codes (CCC) associated with their NIF/NIE.

- Not have net income computable for tax purposes from self-employed activities in the third and fourth quarters of 2021 higher than 75% of the minimum inter-professional salary during this period.

- Accredit in the fourth quarter of 2021 total income computable for tax purposes for self-employed activities of less than 75% of that received in the fourth quarter of 2019.

To calculate the reduction in income, the period of registration in the fourth quarter of 2019 will be taken into account and will be compared with the proportional part of the income in the fourth quarter of 2021 in the same proportion.

The amount of the benefit was 50% of the minimum contribution base for the corresponding business activity carried out. However, when persons united by family bond or similar unit of coexistence up to the first degree of kinship by consanguinity or affinity live in the same home, and two or more members are entitled to this extraordinary cessation of activity benefit, the amount of each benefit was 40%. If they fail to prove that there is no cohabitation, the 10% overpaid of the economic benefit will be reclaimed.

The benefit was recognised from 1 October 2021 if the application was made before 21 October, or effective from the day following the application if it was made after that day and lasted until 28 February 2022.

Summary table, Article 11 of RD-Law 18/2021:

All communications made will be sent to the email address specified at the time in the benefit application form, either by email (favourable resolutions) or by electronic notification (hearing procedures and subsequent resolutions to correct differences or reject the benefit).

In the notification received, the correction ID is at the top of the document, which can be used to access the process on the website, together with the identity document number.

In the same document, is specified the reason why its provision has been revised and a series of circumstances have been detected that they would be able to affect to the fulfillment of the requirements legally established or to the credited amounts. The notification received informs of the opening of the procedure of audience, having a term of 10 business days to present the indicated documentation in every section and being able to formulate allegations and justifications that they consider opportune (it is remembered that are not taken into account on Saturdays, Sundays and bank holidays for the computation of days).

In case is wanted to give up to this procedure of audience, or if within 10 business days the documentation or formulated allegations has not been contributed, will be proceeded to the issuance of definite resolution, dictating agreement denegatorio or of definite granting, but with improper amounts of the provision, demanding amounts that they received in time.

For more information on the documentation required to correct the incident, the notification document received by email lists the manager who can help with the process.

Art. 11 of Royal Decree-Law 18/2021 of 28 September, on urgent measures in defence of employment, economic recovery and the strengthening of the job market.