Frequently asked questions:

Provisional resolutions review of extraordinary benefits for Cessation of Activity (WINETASTING - COVID 19)

Why me send now a letter saying that I do not fulfill requirements of the provision?

Before the health crisis situation that drove to the statement of the state of emergency, the legislator chose to provide at that time the access to provisions, that were recognised in a provisional way. In order to be able to obtain the definitive examination, was necessary a later review both of the documentation, and of the fulfillment of requirements.

Currently, beginning of the process of review has been given of this provision, in such a way that, after analysed credit the contributed documentation and contrasted the information provided by the Directorate General of Ordainment of the Social Security Institute based on the details of the General Treasury of the Social Security (TGSS) and of the National Institute of Social Security Institute (INSS), are sending the notifications corresponding to this financial assistance to the email that was indicated in the application.

Have received definitive examination communication Must carry out some management?

The communication received, confirms as definite the provisional resolution issued in its moment for this mutual society, which it means that the provision is considered definite and validly credited. it is Not necessary to carry out no other stock furthermore.

Have received procedure opening notification of audience What term arrange to reply?

Has received this notification because incidences have been detected that they would be able to affect to the fulfillment of the requirements legally established or to the credited amounts. It has a term of 15 business days (are not taken into account Saturdays, Sundays and bank holidays for the computation of days) to present the indicated documentation in every section and to formulate allegations that it considers opportune.

What happens if I do not send documentation, or if the command out of the indicated term?

If elapsed defined terms in the letter of audience procedure opening does not contribute the documentation, the Mutual Society will issue definite resolution with the available information. Nonetheless, can always contribute that documentation in a later moment, in the phase of previous claim against the resolution, which consequently it would not lose its right to correct incidences.

How will know that I fulfill correctly with the made application?

During the term of audience procedure, after the assessment of the documentation that it sends us, will be issued by the Mutual Society the definite resolution in which will indicate him to him if is ratified him initial examination (in which case it does not have to carry out activity some), if it proceeds the refusal of the right provisionally recognised, or if it remains, but modified in amount or period to be received. In these latest two suppositions the way will indicate him to him in which will be able to state disagreement with its case within of not being in agreement.

In case it is determined that have received all or part of the amount as an improper provision. How much will have to pay/of what way/in what term?

Once the resolution denegatoria or of examination reduced in amount is steady, will receive communication in which amount to be returned, way will indicate him to him of carrying out the payment and term to make the same one.

I can pay the debt of fractionated way?

The Mutual Society does not have authorisation to agree fractionated payments of debts for improper provisions. In the event of not paying, the claim of the debt will be processed via the General Treasury of the Social Security, organisation with which yes can arrive at an agreement of fee-paying fractionation of the debt.

They indicate me in the letter that I have debt with the Social Security Institute. How can know the amount?

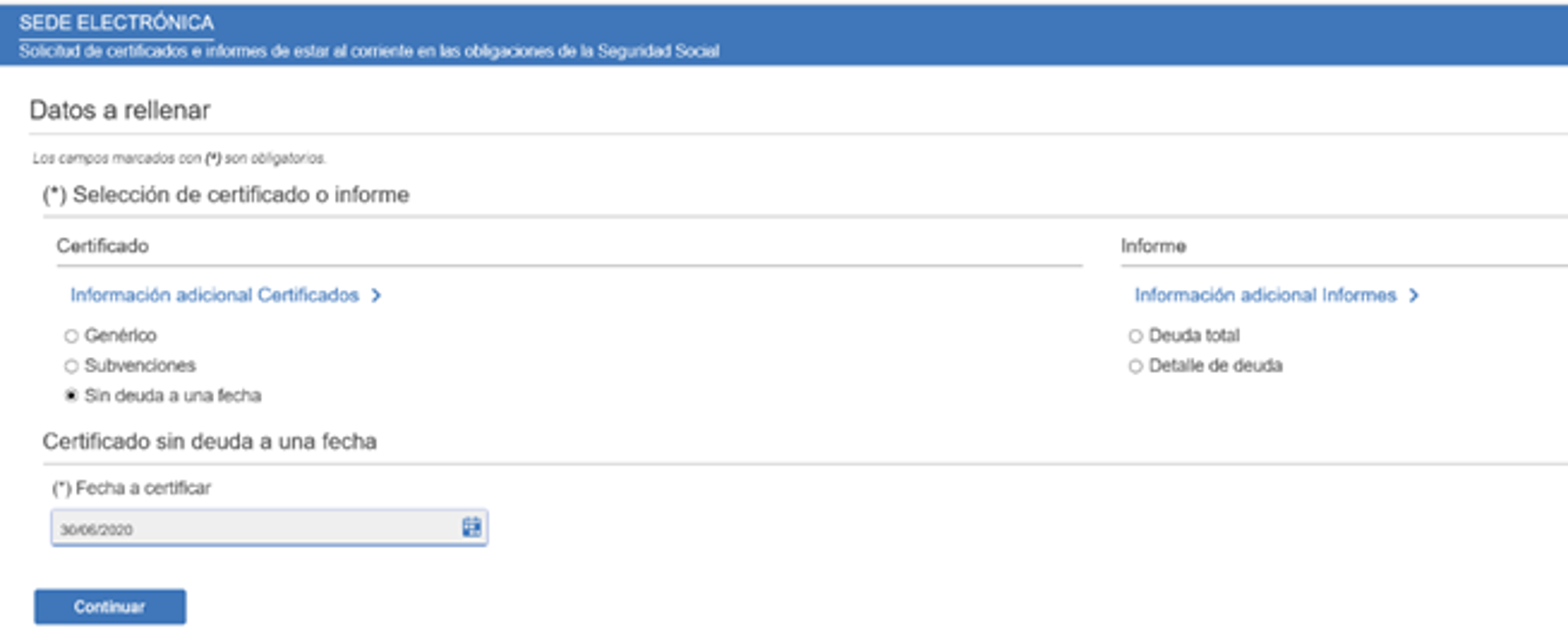

It can know the amount of the debt for two ways, good accessing the e-Office of the Social Security Institute, where via the option of reports and certificates will be able to obtain the debt certificate, the period to that which corresponds and its amount, good attending presencialmente a branch from the General Treasury of the Social Security, requesting in the same one the issuance of the debt certificate or of being aware of payment.

I had a debt with the Social Security Institute but it already had it paid before its communication. How it demonstrate?

With the contribution of a certificate of being up to date in the contributions issued by the General Treasury of the Social Security, document that can obtain good accessing the e-Office of the Social Security Institute, and indicating that it requests a certificate without debt to a date, with the detail of debt and to download it in its report section and certificates, or attending presencialmente a branch from the General Cash Management of the Social security, requesting in the same one the issuance of the certificate. An example:

They indicate me in the letter that was not of registration in the System RETA. How can prove my situation?

To have right to the perception of the extraordinary benefit for cessation of activity, was requirement unavoidable to be of registration in the System RETA in the date of the statement of the state of emergency (14/03/2020). To prove this situation, he must contribute a certificate of the General Treasury of the Social Security (TGSS) where they learn more about different registrations and cancellations in the special scheme of self-employed workers.

How prove that I have not unsubscribed me in the regime of self-employed workers before 30/06/2020?

To maintain the right to the perception of the extraordinary benefit for cessation of activity for reduction of the invoicing, it was indispensable to remain of registration in the special plan for self-employed workers during all the period of the provision, having detected by our part that the cancellation has been produced in the regime later than the beginning of the provision. In the case of not being thus it, he should provide supporting documentation of the permanence in the special scheme during all the period of receive of the provision (work life, etc.…).

They indicate me in the letter that an activity of CNAE that the activity is not matched that it carried out. How can prove my activity?

The communicated CNAE in the notification is that which appeared it to the General Treasury of the Social Security to the date of granting of the provision. To prove the activity, he should contribute supporting official record of the CNAE in the date of the fact responsible for the provision or accreditation of the registration in the IAE.

They indicate me in the letter that the fee-paying base of the provision is wrong How can prove her?

If it considers that the provision that paid him to him was correct, he should contribute supporting documentation issued by public institution where contribution bases are proved in twelve previous months at the start of the provision. In the following link it can access the requested thing: Categorias (seg-social.gob.es)

They indicate me in the letter that there is confluence with another provision of the Social Security Institute How can justify it?

The notification informs the concurrent period between provisions of the incompatible Social Security Institute with the extraordinary benefit for cessation of activity. If this information is not correct, he must present some following documents, according to the situation in which is found:

- Certificate issued by the National Social Security Institute (INSS) where it learns more about the non-existence of the perception of another provision of the Social Security Institute where they appear, clearly, the dates of granting or affectation.

- Certificate issued by the INSS where it learns more about the perception of another provision of the Social Security Institute, where they appear, clearly, the dates of granting or affectation.

I accessed an active retirement in the period of the provision. Why say that it is incompatible if I continued working?

The access a provision from retirement is incompatible with the cessation of activity, for that reason, is incompatible from the start date of this. Different question would be if the active retirement was recognised dated prior to the beginning of the provision for cessation of activity, in which case yes would would be compatible both situations.

Tax contribution for modules. How can prove the reduction of invoicing?

It can prove the reduction contributing countable documentation, loss and gains account, issued invoices book and received, as well as any other admitted element of proof in right.

The period in which it is necessary to prove the reduction (month) does not coincide with no tax period. How prove my invoicing reduction in that month?

It can prove the reduction contributing countable documentation, loss and gains account, issued invoices book and received, as well as any other admitted element of proof in right.

While I received the provision, and some months later, I did not have to pay the contribution to the Social Security Institute. The loss of the provision at this time would affect to those contributions?

The exemption of contribution to that which adverts to was linked to receive the of the provision, if at the time refuses him to him, will entail also that the General Treasury of the Social Security demands him the deposit of the contribution of those periods.

The loss of this provision me will affect to the later ones that I received?

It will depend on the type of provision that it would have requested, and of the period of receive of the same, since not all later provisions are linked, although some yes it are and, therefore, if so you would be able to entail the later refusal of those later aids linked and that they included as one of the perceived credit requirements previously the PECATA (Extraordinary Benefit article 17 Royal Decree-law 8/2020).