Review of the extraordinary benefit of cessation of activity for affected by a temporary suspension of all the activity for resolution of the statutory authority as a measure of containment of the virus COVID-19

Established in the article 5 of the Royal Decree-Law 2/2021, of 26 January, of support and consolidation of social measures in defense of the employment.

The examination of the regulated provision in this article was owed to request within the first 21 calendar days next on the coming into force of the agreement or activity close resolution.

If the application was presented out of the prescribed time, the right to the provision the day of the application was initiated. In such cases, the worker or worker was exempt from the obligation of paying contributions from day one of the month in which the provision has been requested.

The self-employed worker must meet the following requirements:

- Be members and in registration in the Special Regime of the Social Security Institute of the Freelance workers or Self-employed workers or, where applicable, in the Special Regime of the Social Security Institute of the sea workers, before 1 January 2021.

- Find up to date in the payment from the fees to the Social Security Institute. However, if on the date of the suspension of the activity this requirement is not met, the management body will invite the self-employed worker to pay the amount due within a non-extendable period of thirty calendar days. The regularisation of the due amounts will generate full effect as regards acquiring the right to the protection.

During the time that remains the suspended activity was had to maintain of the registration in the corresponding special scheme being the disburdened self-employed worker of the obligation of paying contributions.

The exoneration of the fees' deposit was spread from day one of the month in which the measure of activity close was adopted until the last day of the next month to that which got up this measure.

The period in which the self-employed worker is exempt from the obligation to pay contributions will be understood as time contributed and the contributions corresponding to this time will be paid by the entities from whose budgets the corresponding benefit is covered.

The applicable contribution basis during everything the period of perception of this extraordinary benefit went in any case the one established in the moment of beginning of this provision.

I receive the of the provision was incompatible with the perception of a remuneration for the development of a work as an employee, unless incomes of the work as an employee were lower than 1.25 times the amount of the minimum wage; with the performance of another activity on a self-employed basis ; with the perception of yields from the society whose activity affected by the close has been seen; as well as with the perception of a provision of Social Security Institute except for anyone who the payee came receiving for being compatible with the performance of the activity that it developed.

The time of perception of the provision did not reduce periods of provision for cessation of activity to those which the payee can have right in the future.

The amount of the provision went of50 % of the minimum base of contribution that it corresponds for the developed activity.

This amount will be increased by20 % if the self-employed worker has recognised the condition of member of a large family and only incomes of the family unit or analogous during that period come from its suspended activity.

- In the event of large family, unless it would have indicated that it had more than a payee of the provision within the family unit or of coexistence in first degree, will affect only to those which received 70% of amount. They must prove incomes of the family unit or of coexistence in first degree.

The supporting documentation that they should contribute will be the next one:

- Large family's certificate.

- Sworn statement signed by all the convivientes people who are legally of age of not credit received more incomes within the family unit during the provision. In the event of not proving, 20% will demand him to him paid by the condition of large family.

Nonetheless, when they coexist in the same people address united by familiar or unit link analogous of coexistence until the first one degree of relationship because of consanguinity or affinity, and two or more members have right to this extraordinary benefit of cessation of activity, the amount of each one of the provisions will be of 40 per cent, being not of application the forecast mentioned in the previous section for large families.

The supporting documentation that they should contribute will be the next one:

- Historic residency registration certificate of coexistence or any admitted test in right that proves people that they integrated the family unit or of coexistence on beginning of the provision.

- Sworn statement of not perceived credit this provision no other member of the family unit during receive the of the provision.

In the event of not proving coexistence 10% will demand him to him subscriber.

All communications made will be sent to the email address specified at the time in the benefit application form, either by email (favourable resolutions) or by electronic notification (hearing procedures and subsequent resolutions to correct differences or reject the benefit).

In the notification that will be received, at the top of the document is found the GO of subsanación, with which you will be able to access the procedure website, together with the number of identity document.

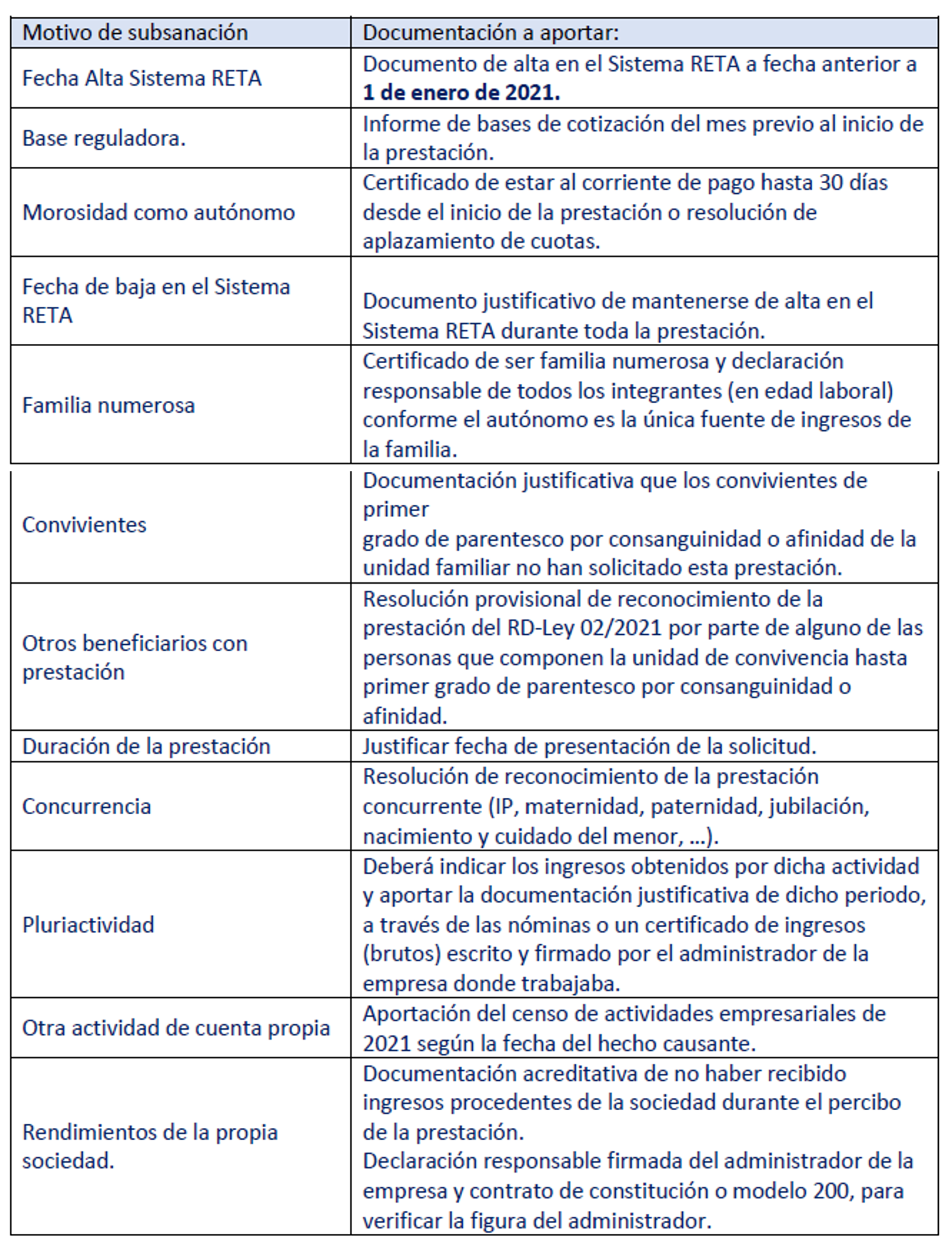

The same document details the reason why the benefit is under review and the number of incidents detected that could affect compliance with the legal requirements or the amounts paid. The notification received informs of the opening of the hearing procedure, setting a period of 15 business days to present the documentation specified in each section, and to present any evidence and justifications deemed appropriate (remember that Saturdays, Sundays and bank holidays are not included when calculating the days).

If the recipient wishes to waive this hearing procedure, or if no documents or evidence have been presented within 15 business days, a final decision will be made, either issuing or rejecting the benefit on a definitive basis. If the benefit is deemed to have been received unduly, the associated amounts received will have to be repaid.

For more information on the documentation required to correct the incident, the notification document received by email lists the manager who can help with the process.

GOVERNMENT ROYAL DECREE 02/2021. Article 5.