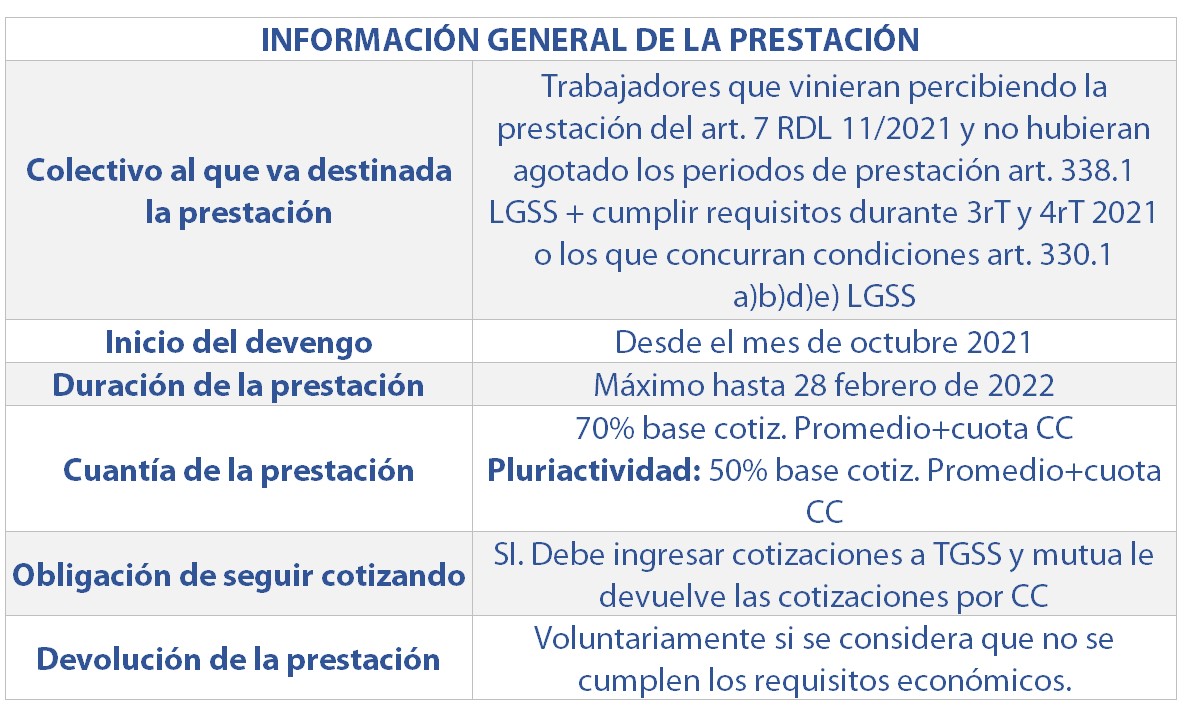

Review of the provision for compatible cessation of activity with the work on a self-employed basis (POECATA 5)

Established in the article 10 of the Royal Decree-Law 18/2021 of 28 September, of urgent measures for the employment protection, the economic recovery and the improvement of the labour market.

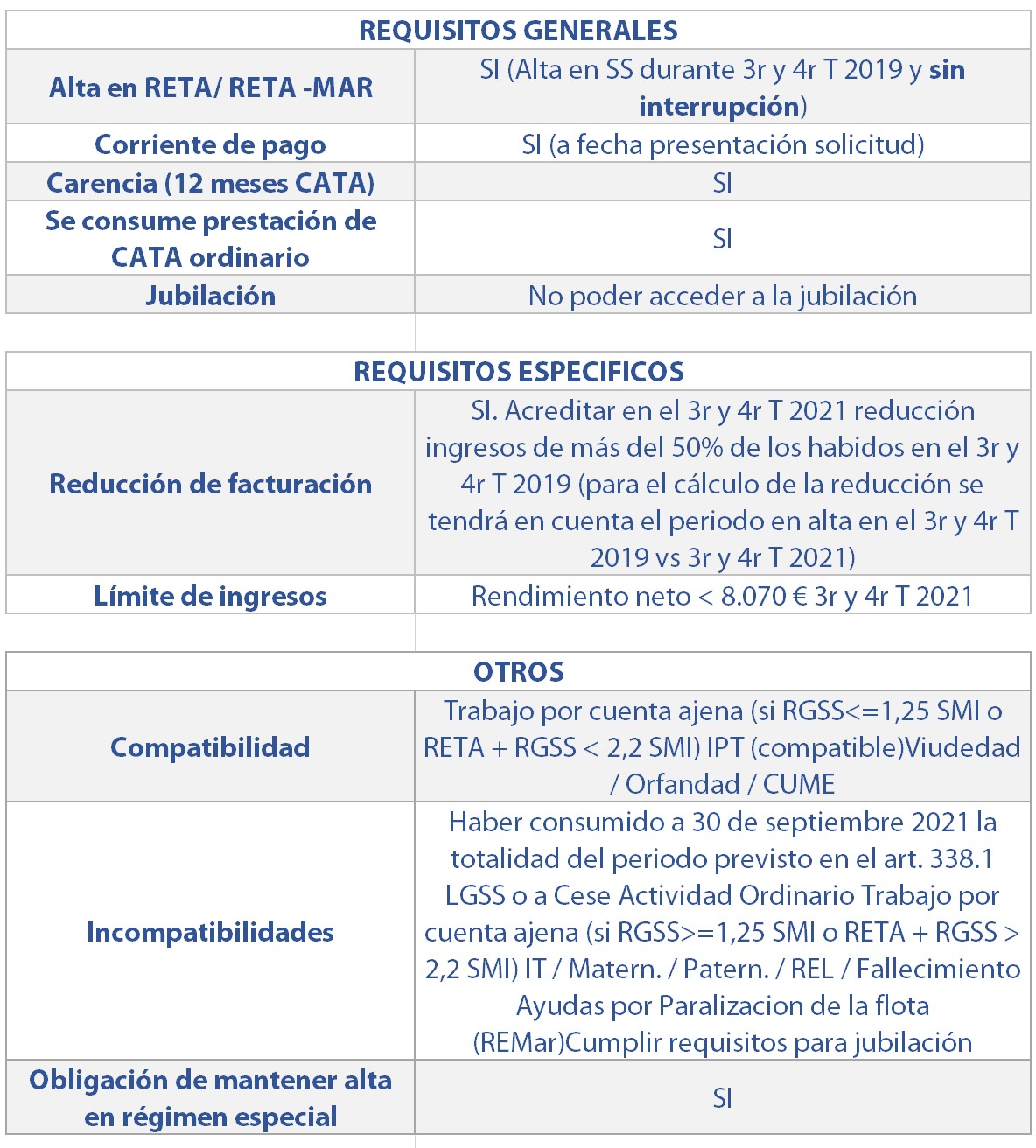

The self-employed worker must meet the following requirements:

- Comply with the requirements established in sections a), b), d) and e) of the article 330.1 of the TRLGSS.

- Otherwise, they must:

- Come receiving the provision for compatible cessation of activity with the work on a self-employed basis regulated in the article 7 of the Royal Decree-Law 11/2021, of 27 May, and not sold out credit periods of provision considered in the article 338.1 of the legislative law of the Social Security Act, approved by the Legislative Royal Decree 8/2015, of 30 October.

- Have 12 months of coverage RETACEA (article 338 of the ROYAL DECREE-LAW 8/2015, of October) not computed for the examination of an earlier right of the same nature (POECATA / POECATA 2 / POECATA 3/POECATA 5).

- Not fulfilled credit the ordinary age to cause right to the contributory pension of retirement, unless the self-employed worker did not have accredited the period of required contribution for this.

- Find aware of payment of the social security contributions . If in the date of the provision of the application the requirement of being was not fulfilled up to date in the payment of contributions, will be invited to the payment to the self-employed worker so that in the term improrrogable of thirty calendar days enters owed fees.

- Prove a reduction in the invoicing in the third one and fourth quarter of 2021 of more than 50% in relation to the third one and fourth quarter of 2019.Para justifying this reduction self-employed workers us will have to contribute:

- Copy of the model 303 of autosettlement of the Value added tax (VAT), corresponding to statements of the third one and fourth quarter of 2021 and of 2019.

- Copy of the model 130 corresponding to the autosettlement in fractionated payment of the Personal income tax (PERSONAL INCOME TAX) of the second one, third and fourth quarter of 2021 and of 2019.

- Self-employed workers that they pay taxes in the Personal income tax (PERSONAL INCOME TAX) for objective evaluation, model 131, they should contribute the documentation necessary to prove demanded incomes in this precept.

- Not obtained credit during the third one and fourth quarter of 2021 some net yields higher than 8,070 euros.

- If the self-employed worker has one or more hard-working to its charge, he owe prove to the time of requesting the provision the fulfillment of all Social Security labour obligations that they have assumed. To this end, they will issue a statement of compliance, and may be required by Mutual Universal to provide the pertinent supporting documents that accredit this situation.

- The provision of cessation of activity will be able to be compatible with the work as an employee , being applicable conditions in this supposition the next ones:

- Net income from the work on a self-employed basis and incomes from the work as an employee will not be able to exceed 2.2 times the minimum wage. In determining this calculation, income from employed work will not exceed 1.25 times the amount of the minimum inter-professional wage.

The amount of the provision will be the one equivalent to70% of the calculated benefits base as the average of the contribution bases out of the 12 months immediate prior to the beginning of the provision applying limits of the PUBLIC INDICATOR OF MULTIPLE EFFECT INCOME. In the event of proving the compatibility with the work as an employee , the amount of the provision will be the one equivalent to 50% of the minimum base of contribution that it corresponds for the activity carried out in the Special Regime of the Social Security Institute of the Freelance workers or Self-employed workers or, where applicable, in the Special Regime of the Social Security Institute of the sea workers.

The provision was recognised starting from 1 October 2021 if the application was completed before 21 October, or with effects from the next day to the application if was completed after that day and it lasted until 28 of February 2022.

The self-employed worker, during the time that received the provision, it had to enter in the General Treasury of the Social Security all contributions applying rates in force to the corresponding contribution basis. This Mutual Society paid to the worker together with the provision for cessation of activity, the amount of the contributions for common contingencies that it would had corresponded him to enter of finding the self-employed worker without developing activity one, in application of the stated in article 329 of the legislative law of the Social Security Act, approved by the Legislative Royal Decree 8/2015, of 30 October.

Summary table article 10 Royal Decree - Act 18/2021:

All communications made will be sent to the email address specified at the time in the benefit application form, either by email (favourable resolutions) or by electronic notification (hearing procedures and subsequent resolutions to correct differences or reject the benefit).

In the event of not appearing opening of the electronic notification will be sent burofax to guarantee that the great procedures volume of audience is made.

In the notification that has been received, at the top of the document is found the GO of subsanación, with which you will be able to access the procedure website, together with the number of identity document.

The same document details the reason why the benefit is under review and the number of incidents detected that could affect compliance with the legal requirements or the amounts paid. The notification received informs of the opening of the procedure of audience, having a term of 10 business days to present the indicated documentation in every section and being able to formulate allegations and justifications that they consider opportune (it is remembered that are not taken into account on Saturdays, Sundays and bank holidays for the computation of days).

In case is wanted to give up to this procedure of audience, or if within 10 business days the documentation or formulated allegations has not been contributed, will be proceeded to the issuance of definite resolution, dictating agreement denegatorio or of definite granting, but with improper amounts of the provision, demanding amounts that they received in time.

If is needed know more information on the documentation to be contributed to correct the incidence, in the document of the notification that has been received for the email, the person manager is found that it will be able to help him at all times .

Royal Decree-Law 18/2021 of 28 September, of urgent measures for the employment protection, the economic recovery and the improvement of the labour market.