More frequently asked questions on the extraordinary benefit for self-employed workers

How justify that my invoicing has been reduced, at least, by 75% with respect to the previous half?

All applications must be accompanied by a sworn statement that all requirements for benefit eligibility are met.

All documentation held by the self-employed worker supporting their sworn statement (record of invoices issued and received; of the journal of incomes and expenses; of the record sales book and incomes; or of the book of purchases and expenses) owes be at the disposal of the mutual society, but not accompanying to the application.

Which is the period through which corresponds the deposit of the extraordinary benefit for cessation of activity?

The period through which corresponds the deposit of the extraordinary benefit for cessation of activity will be initiated in the date of the fact responsible for, moment in which the right is yielded to the provision and that not necessarily has to coincide with the date of taking effect of the Royal Decree 463/2020 that it declared the state of emergency (14 March 2020).

When the application arising from suspension of the activity, the start date of the provision is had is that one of the beginning of the state of emergency (14/03/2020), regardless of when done the application of provision is had.

If the reason was reduction of invoicing of, at least, 75%:

- If the invoicing has been seen reduced during March, right cause to the same one on 14 March.

- If the invoicing has been seen reduced during April, it is owed to request the provision in May and it will cause right to the same one in on 1 April.

- If the invoicing has been seen reduced during May, it is owed to request the provision in June and it will cause right to the same one in on 1 May.

In all cases the provision will be spread until the last day of the month in which finishes the state of emergency.

Where have to request the extraordinary benefit for motivated cessation of activity for COVID-19?

With general character, the management of this provision will correspond to the collaborative mutual society with the Social Security Institute to that which is assigned the worker or worker.

In the case of self-employed workers in registration in the Special Plan for Sea Workers, the management corresponds to the Social Marine Institute. Finally, in the supposition (residual) of the self-employed workers that they have private the protection for occupational contingencies with the NATIONAL Institute of the Social Security Institute, the management corresponds to the Public Service of State Employment (SEPE).

Some minimum period is demanded of contribution to request her?

No. To request this provision it is not necessary to fulfill the minimum period of demanded contribution for other provisions, is just necessary be of registration in some regimes (self-employed workers or in the regime of the sea on a self-employed basis) and to find aware of payment of the social contributions.

What amount will charge self-employed workers that have the minimum period of lack?

With general character, will be equivalent to 70% of the benefits base, having in account for its calculation the average of the bases out of the twelve months continuing and immediately prior to the legal situation of cessation. Maximum and minimum amounts will be applied applying the pocentajes of the PUBLIC INDICATOR OF MULTIPLE EFFECT INCOME legally established in the Legislative Royal Decree 8/2015 (Legislative law of the Act of Social Security Institute).

For who has paid contributions fewer than twelve months before the statement of the state of emergency, the provision will be of 70% of the minimum base of contribution of the group to that which belongs the worker.

There is difference in the amount of the provision if the minimum period of lack is not had?

Yes. When the minimum period of contribution is not proved 70% of the minimum base of contribution will be received in the Special Regime of the Social Security Institute of the Freelance workers or Self-employed workers or, where applicable, in the Special Regime of the Social Security Institute of the sea workers, that it corresponds them by activity.

How long the extraordinary benefit will be received for Cessation of Activity?

Until the last day of the month in which finishes the state of emergency, regardless of that the business is reopened during the desescalada.

If I have several activities on a self-employed basis, you can request the provision for all of them?

It will just be able to request the extraordinary benefit for one of the activities on a self-employed basis that it is carrying out. Notwithstanding the above, owing to the fact that the registration is unique in the RETA regardless of activities that they take place, to have access to the extraordinary benefit owes of credit stopped in all of them or to reduce the invoicing in all of them by 75%.

What documents must present or to offer the mutual society in case they are me required at any time, later than the application of the provision?

- Family book (libro de familia) or equivalent document in the case of foreigners, if they have children in their care.

- General Treasury of the Social Security's certificate (TGSS) of being aware of payment.

- In the case of deferral of outstanding instalments to the General Treasury of Social Security: resolution of the TGSS, of the deferment of the fee-paying outstanding installments, and monthly verification slips of the payment and fulfillment of the prescribed times in the same one.

- If there are contributions made abroad: supporting documentation for contributions made abroad.

- Administrative or judicial resolution recognising the corresponding benefit or aid, if any has been granted.

- Specific documentation to provide when a reduction in invoicing is claimed: Logbook of invoices issued and received; daily log of income and expenses; logbook of sales and income; purchase and expenditure book, or any other admitted element of proof in Law to prove this reduction in the invoicing

The RETA has to carry out the procedure of giving of cancellation of the regime of Social Security Institute and, also, to present 036 of business cancellation in the case of close, although to effects that time is considered as quoted?

It is an ANALOGOUS extraordinary benefit To THAT ONE OF CESSATION OF ACTIVITY. It is a temporary suspension of activity for the statement of the state of emergency, which is why self-employed workers DO NOT HAVE And THEY SHOULD NOT GIVE OF CANCELLATION IN THE TAX AGENCY NOR IN THE TESORERIA GENERAL OF THE SOCIAL SECURITY.

The above-mentioned perception period of the extraordinary benefit for Cessation of Activity will be considered as quoted and will not be discounted of periods of provision for Cessation of Activity to those which the payee can have right in a future.

The self-employed worker that copper the extraordinary benefit for motivated cessation of activity for COVID-19, has also that to pay contributions February 2020 taking into account that in that one moment the state of emergency had not yet been decreed?

The extraordinary benefit for Cessation of Activity has effects from the statement of the state of emergency (14.03.2020), therefore, the fees prior to the Decree must be satisfied and is also a requirement for the access of the extraordinary benefit established in the article 17.1 section C of the Royal Decree-Law 8/2020 of 18 March:” Find up to date in the payment from the fees to the Social Security Institute”.

1.- applications for self-employed workers whose activities are suspended in virtue of the one considered in the Royal Decree 463/2020 you will be able to carry out from 18 March 2020 (coming into force of the Royal Decree-Law 8/2020 of 18 March).

2.- applications for self-employed workers whose activities have not been suspended and they do not have carried out an ERTE of its staff, but have seen reduced its invoicing in, at least, 75% in March with respect to the previous half, they should present applications starting from 01.04.2020, once completed the monthly payment with the object of being able to to have the definite invoicing of the month and, therefore, being able to prove this reduction in its invoicing.

I have to pay the contribution of March?

It will be owed to pay the contribution corresponding to preliminary days to the statement of state of emergency. Nonetheless, if everything was paid the month for not having been granted the provision before the money order of the fees, the TGSS will return the part corresponding to the period that was receiving the provision of cessation of activity, this refund will be done by trade, but nothing impedes to the interested party its claim via the system RED

You can even access having some debt with the Social Security Institute?

Yes. The Social Security Institute will allow who are not aware of payment of the fees to the Social Security Institute in the date of the suspension of the activity or of the reduction of the invoicing, that they enter owed fees in a term of 30 calendar days. Once carried out the payment, you will be able to access this provision.

Additionally can request it self-employed workers that have workers to its charge?

Yes, but are given two differentiated situations:

- In the event of carrying out the application for reduction of its invoicing, at least, 75% with respect to the previous half, following in operation the activity of the company with workers, can request this cessation of activity extraordinary benefit without the need for procedure of ERTE of the company with workers.

- In the event of carrying out the application for suspension of the activity as a self-employed worker, previously has to process ERTE of the company with workers.

If they suspend the activity, have to give up to discounts which enjoy, conditioned to the maintenance of the activity, as the flat rate?

No. Following on from this, the decree indicates that the time that this extraordinary benefit is received will count as indeed quoted, which is why they will be able to request her self-employed workers that are receiving these aids and they will not lose conditioned discounts to the maintenance of the activity.

What happens with self-employed workers that are obliged to follow providing service, as cabbies?

They will be able to take in, where applicable, to the provision if they prove the reduction in its invoicing of, at least, 75%. In this case, there will not be no problem in reconciling the provision and the activity.

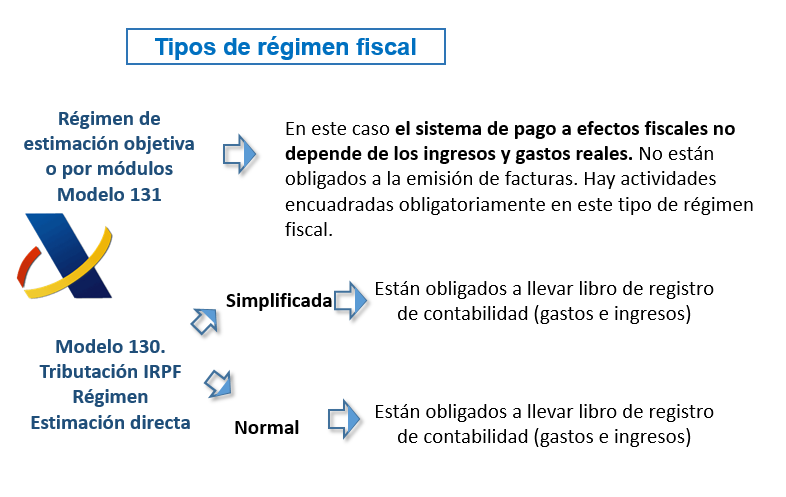

How is going to recognise the loss of invoicing of a self-employed worker that it pays taxes for modules?

Those self-employed workers that are not obliged to take books that prove the volume of activity, they should prove the reduction at least of 75% demanded using any means of admitted test in right.

(Final provision article 1 of the Royal Decree-Law 11/2020, modifying the Royal Decree-Law 8/2020).

Caso specific to collaborative familiar self-employed workers, which is its situation regarding this provision?

All the self-employed workers obliged to suspend its activity for the state of emergency or with a reduction of its invoicing of, at least, 75%, have right to the extraordinary benefit of Cessation of Activity, regardless of its condition. The collaborative relatives or collaborative self-employed workers are included within the Special Scheme for Self-Employed Workers, which is why they have right to the extraordinary benefit, as long as they fulfill established requirements.

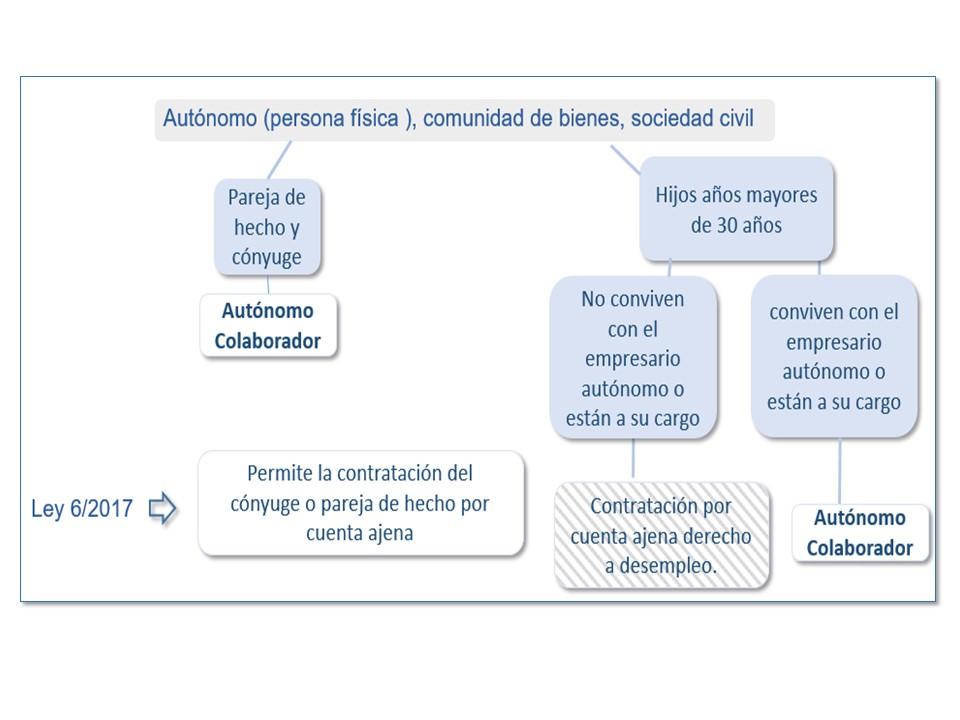

SELF-EMPLOYED WORKER clarification and definition COLLABORATOR

A collaborative self-employed worker is a direct relative of the self-employed worker holder that it works for him. The requirements for to pay contributions as collaborative self-employed worker are the next ones:

- Direct relative: spouse, descendants, ancestors and other relatives of the employer, because of consanguinity or affinity until the second degree inclusive and, where applicable, for adoption.

- That are occupied in its common form centre or work centres. He should not be a punctual collaboration.

- Explain that from Act 6/2017, of 24 October, of Urgent Refurbishment of the Freelance Work, couples in fact they can already be of registration and to pay contributions in the Special Scheme for Self-Employed Workers.

OUTLINE ACLARATIVO COLLABORATIVE RELATIVES OBLIGED To TO GIVE OF REGISTRATION And To PAY CONTRIBUTIONS IN THE SPECIAL PLAN FOR SELF-EMPLOYED WORKERS.

For cases in which the RETA has to present supporting documentation of reduction of invoicing of, at least, 75% with regard to the average of the previous half, how is owed to prove? on what month that reduction of 75% is considered?

For presented applications in March and April, the comparative one will be made on March with respect to the period September-2019 to February-2020, despite the fact that the Royal Decree-Law 11/2020 makes reference a month prior to that which the provision is requested.

For presented applications in May the comparative one will be made on April with respect to the period October-2019 to March-20.

For presented applications in June the comparative one will be made on May with respect to the period November-2019 to April-20.

The accreditation of the invoicing's reduction will be made through the contribution of the countable information that it justifies it, being able to do via the copy of the book of issued invoices record and received; of the journal of incomes and expenses; of the record sales book and incomes; or of the book of purchases and expenses.

Those self-employed workers that are not obliged to take books that prove the volume of activity, they should prove the reduction at least of 75% demanded using any means of admitted test in right.

(Final provision article 1 of the Royal Decree-Law 11/2020, modifying the Royal Decree-Law 8/2020).

It will be enough with to fill the application of the provision, in which a declaration of Responsibility is included, through which the applicant formally declares that it complies with requirements for the access to the right to the extraordinary benefit of cessation of activity and to present or, where applicable, to offer the Mutual Society the documentation that is required. This documentation made available by the applicant will be able to be required at any time by the Mutual Society before that which the application is formulated.

A self-employed worker with deferment of debt and fulfilling periods of credit of this debt, has right to the provision for motivated cessation of activity for COVID-19?

The self-employed worker that it has granted the deferment of debt by the General Treasury of the Social Security before the Decree of the state of emergency (14 March 2020 –date suspension of activities), aware of the payment is considered when it comes to its obligations with the Social Security Institute, which is why it will be able to access as in any financial assistance of the Social Security Institute.

If the invoicing is reduced, at least, by 75% with regard to the average of the previous half, what happens if the self-employed worker not yet takes registered in the regime six months?

When in March 2020 the self-employed worker DOES NOT take of registration in the regime the six demanded calendar months, the assessment will be carried out taking into account the period of activity that it takes registered.

What activities are suspended in virtue of the Royal Decree through which the state of emergency is declared?

For the checkout of if its activity is found between the suspended ones for the statement of the state of emergency (Royal Decree 463/2020, of 14 March, modified by the Royal Decree 465/2020, of 17 March), a relationship of CNAE is offered (National Classification of Economic Activities) of guidingcharacter, that it does not exclude the possibility of that, according to the activity indeed made by the self-employed worker, the same one could have lace between these suspended activities, despite not finding in this relationship, that is offered to the mere effects of assistance for the self-employed worker applicant. Mutua Universal will consider, a posteriori, that the activity can not carry out of way not in person or that, for autonomous or local standard, have been suspended.

Similarly, please note that, if the activity of the self-employed worker is not among those suspended by the aforementioned regulations, they can still apply for the benefit if their turnover for the month prior to the application was down by at least 75% compared to the monthly average of the calendar semester prior to March 2020 (these periods may vary for certain cultural activities and for seasonal farming activities).

It exists the obligation of paying contributions during the period of perception of the extraordinary benefit?

The provision consists of that who causes right to her not only it will not pay it, but instead that also the above-mentioned period will have him to him for quoted, and it will not reduce periods of perception of the provision ordinary by cessation of activity to those which the payee can have right in the future.

The General Treasury of the Social Security will not happen the bill during the perception of this provision, but if for whatever reason charged it, the refund by trade will be.

As you can request the refund of the admitted fees unduly?

Those freelance workers to those which the extraordinary benefit recognises them to him for cessation in the activity should not pay contributions to the Social Security Institute during the period that lasts the aforementioned provision. If arrives at him to him to charge in account aforementioned fees for not credit been recognised on time the provision by the corresponding body manager, these fees will be returned by trade by the General Treasury of the Social Security , which is why not is specified to carry out with regard to these fees no moratorium application or deferment.

That term exists to request the refund of fees to the Tesoreria General of the Social Security Institute?

Self-employed workers to those which the extraordinary benefit recognises them to him for cessation in the activity to that which adverts the article 17 of the Royal Decree-Law 8/2020, they should not pay contributions to the Social Security Institute during the period that lasts the aforementioned provision and that, if arrives at him to him to charge in account aforementioned fees by the corresponding body manager, these fees by trade by the General Treasury of the Social Security will be returned, which is why not is specified to carry out with regard to these fees no moratorium application or deferment.

If the self-employed worker maintains debt with the Social Security Institute, can request the refund of the fees?

Yes. In such cases, the credit for the refund will be applied to the payment of the amounts outstanding.

How affects the suspension of terms and interruption of terms for the administrative procedures for the Cash Management of the Social Security Institute?

The suspension of terms affects to the collection, but not to the membership, settlement and contribution. (NEW)

What supposes the suspension of the terms for the state of emergency in the collective procedure?

Involves that all the administrative acts that are made in the field of the above-mentioned procedure have seen suspended terms, which is why will not be made, while it lasts such suspension. This does not involve that is not owed to pay contributions, since the settlement and contribution are excepted of the suspension of the terms, which is why companies and workers must pay contributions as they have come doing up to now. All of this, without prejudice to that workers that take refuge in the provision for cessation of activity, will not have the obligation of paying contributions.

The extraordinary benefit for cessation of activity of the self-employed worker motivated by COVID-19 is compatible with the aids offered by the Govern of the Government of Catalonia to the self-employed workers, or, it has to give up to this assistance to charge the provision of Social security?

The extraordinary benefit for cessation of activity of the self-employed worker motivated by COVID-19 is incompatible with the assistance offered by the Government of Catalonia.

This assistance offered by the Government of Catalonia is set aside for the people self-employed workers - individuals - that they prove a drastic reduction and involuntary of its invoicing as a result of effects of the coronavirus in its economic activity, and provided that they appear of registration in activities which health authorities have decreed the close and they do not have other alternative sources of incomes.

There is some document of the Directorate General of Ordainment of the Social Security Institute regarding this provision?

Yes. You can download it in this link.

What happens if, after initiated credit the charge of the provision, the self-employed worker resumes the activity, or, increases the sales volume?

So much if the reason is suspension of activity as though is reduction of invoicing, the self-employed worker will receive the provision until the last day of the month of completion of the state of emergency.

What happens if the application has been formulated by suspension of the activity and the self-employed worker catches on that its activity is not classed within the Royal Decree 463/2020 (or suspended by autonomous or local standard), and also considers that:

IT WILL NOT be able to prove a reduction of the invoicing of 75% in none of months that lasts the state of emergency with respect to the previous immediate half. In this case can:

- Desist of the application if it has not yet recognised him to se.

- Give up if it has been him recognised. This decision involves the refund of the perceived provision.

YES will be able to prove a reduction of the invoicing of 75% in some months that lasts the state of emergency with respect to the previous immediate half. In this case it can modify the application indicating the month that it wants to point out as a reference for the subsequent verification.

What happens if the application has been for smoked by reduction of the invoicing and account is given that it will not be able to prove her with respect to the previous month and it considers that:

IT WILL NOT be able to it to prove in none of next months. In this case can:

- Desist of the application if it has not yet recognised him to se.

- Give up if it has been him recognised. This decision involves the refund of the perceived provision.

YES will be able to it to prove in some next months. In this case it can modify the application indicating the month that it wants to point out as a reference for the subsequent verification.