Article 5 (RDL 2/2021)

Article 5 (RDL 2/2021) Extraordinary cessation of activity benefit for self-employed workers affected by temporary suspension of all activity.

The period for requesting this benefit has ended.

Starting from 1 February 2021, self-employed workers that obliged to suspend are seen all its activities as a result of an adopted resolution by the statutory authority as a measure of containment in the propagation of the virus COVID-19, will have right a financial assistance from extraordinary nature cessation of activity:

a. Be members and in registration in the Special Regime of the Social Security Institute of the Freelance workers or Self-employed workers or, where applicable, in the Special Regime of the Social Security Institute of the sea workers, before 1 January 2021.

b. You must be up to date with the payment of social security contributions. However, if on the date of the suspension of the activity this requirement is not met, the management body will invite the self-employed worker to pay the amount due within a non-extendable period of thirty calendar days. The regularisation of the due amounts will generate full effect as regards acquiring the right to the protection.

Amount of the provision: 50 per cent of the minimum base of contribution that it corresponds for the developed activity.

This amount will increase by 20% if the self-employed worker has a recognised status as a member of a large family and the only income of the family or similar unit during that period comes from their suspended activity.

Nacimiento from the right to the provision: From the next day to the adoption of the measure of adopted activity close by the statutory authority.

During the time the suspended activity remains, registration in the corresponding special regime will be maintained, and the obligation by the worker to pay contributions will be waived. The exoneration of the fees' deposit will be spread from day one of the month in which the measure of activity close is adopted until the last day of the next month to that which gets up this measure or until 31 of May 2021, if this last date is previous

Duration: The perception of the provision will have a maximum duration of four months, finishing the right to the same one the last day of the month in which remembers the uprising of the measures or on 31 May 2021 if this last date is previous.

RDL 3/2021, of 2 February, important new developments and modifications in the regulation of cessation of activity benefits

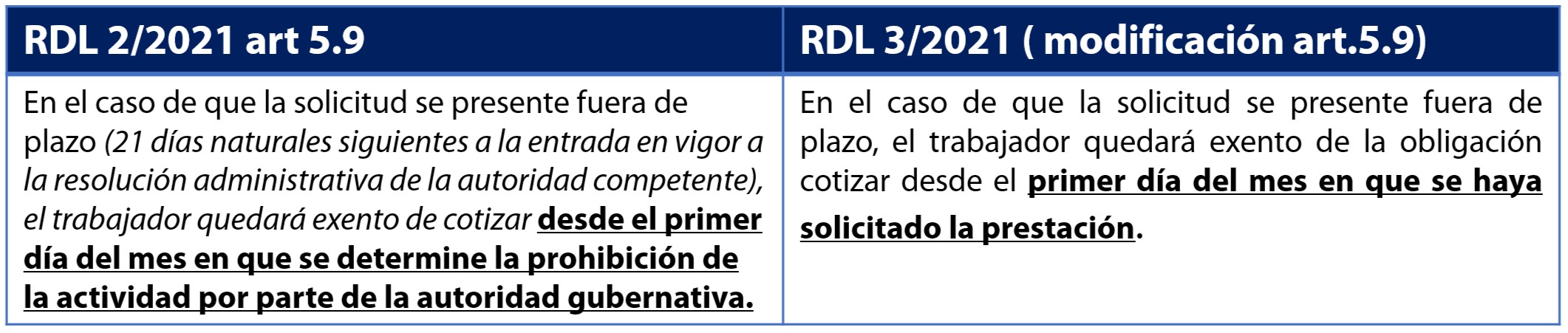

Modification is introduced with respect to the exemption from the obligation to pay contributions, this obligation in the extraordinary benefit for cessation of activity for self-employed workers affected by a temporary suspension (PECANE by its Spanish acronym) is linked to when the application is made and not to when the prohibition of activity is determined by the administrative resolution of the competent authority, the comparative table is attached.

Rectification of applications already submitted